Introduction

Online Payment Platform (OPP) is an end-to-end payment solution with a set of flexible API's designed to support platforms and marketplaces. Allowing a platform to seamlessly onboard new business and consumer merchants enabling them to accept payments on the platform while processing the money in flexible ways to sellers and service providers.

Usecases:

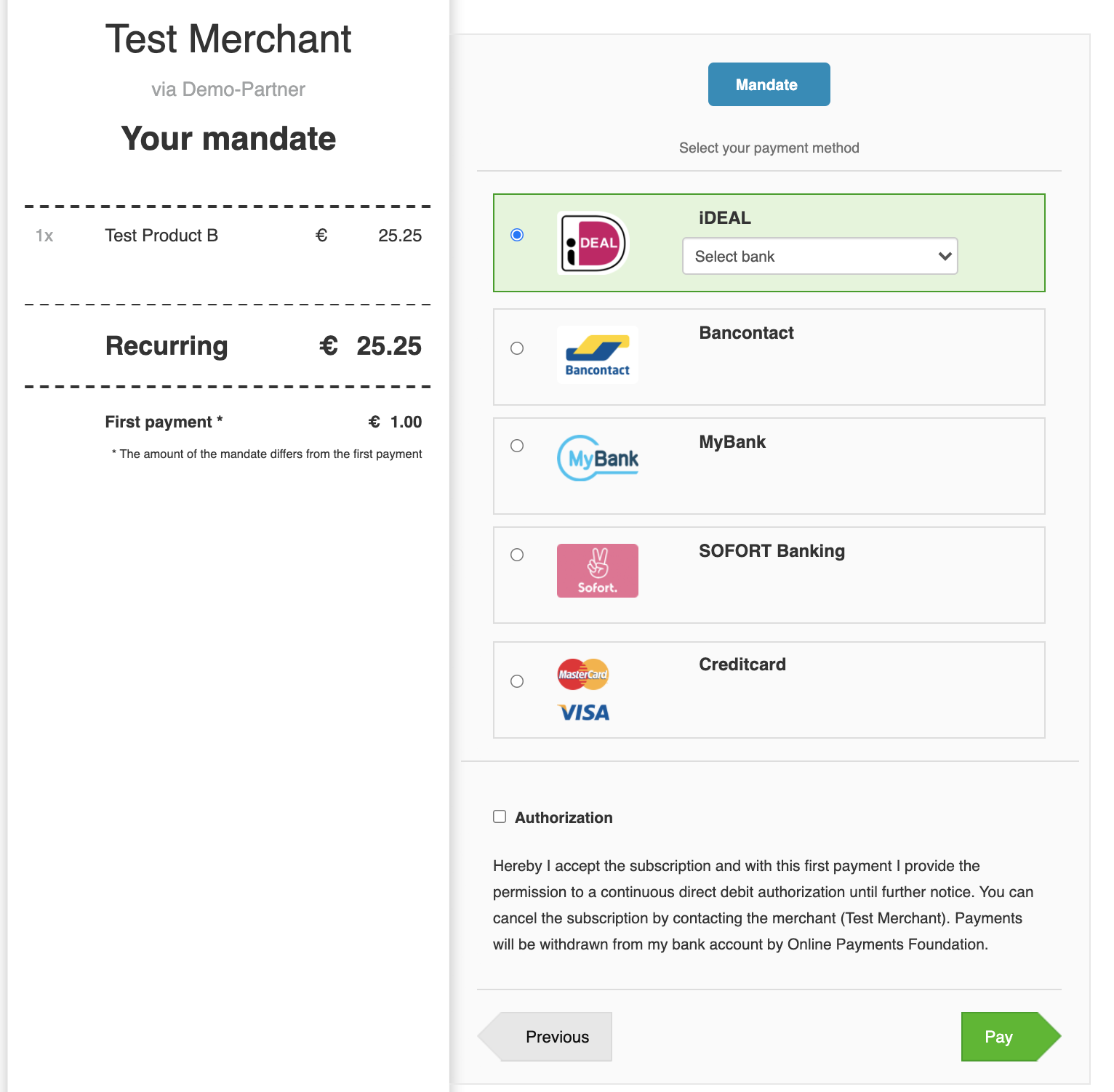

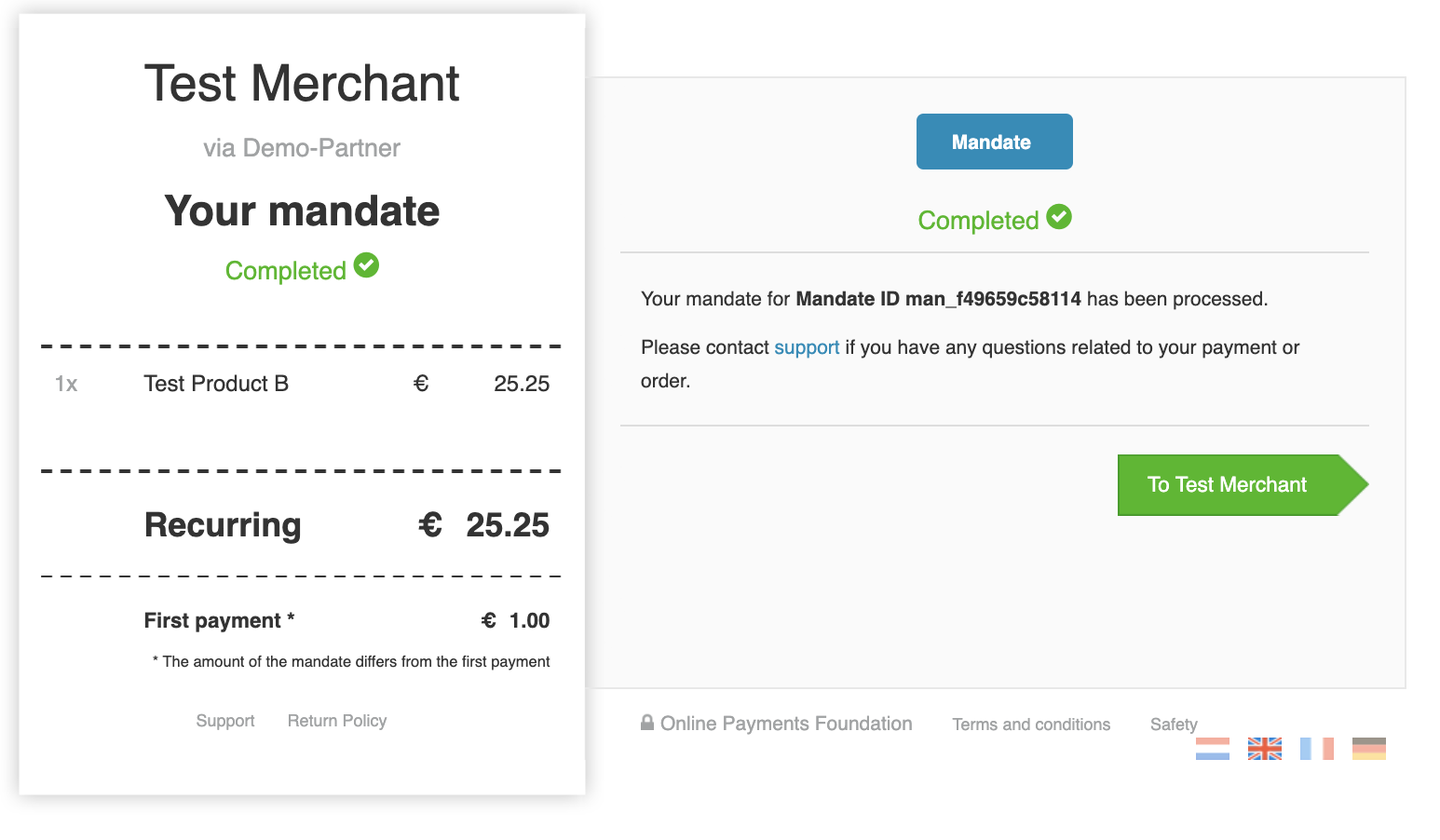

- Marketplaces, like Ebay or Amazon

- Rental, like Airbnb

- Subscription, like Zuora

- Events, like Eventbright

- Ticketing, like Ticketscript or Booking.com

- Education, like universities or highschools

- Services, like Uber or JustEat

- Invoicing, like Exact or Zoho

- and many more...

This guides consist of the following chapters:

- Onboarding: How to onboard a merchant, what possibilities are there, and how does compliance influence everything.

- Compliance: What is compliance, why is it needed and how does it influence my payment flows?

- Transactions: How to start a transaction, and how to handle the unhappy flows.

- Dashboarding: How to create your own dashboard for merchants, and for yourself.

Let's get started!

Before we start, have a look at our terminology, to make sure you understand every word we say.

For each receiver of the money, the partner (platform) is required to create a merchant within OPP. A merchant can be a business or a consumer. Depending on the type of merchant, these have to go through different verifications before they can receive money. It is important to note that transactions can be initiated for a merchant before they are required to finalize any verifications, but it is up to you whether you want to provide this possibility.

These verifications are required for processing payments because as a Payment Service Provider we are obliged to know to whom payments are made. For example to prevent money laundering and the financing of terrorism.

Merchants can be created using our Seamless Merchant onboarding. Seamless onboarding allows you to onboard merchants (business or consumer) seamlessly from within your platform environment through API onboarding.

Advantages

- Seamless integration

- More flexibility with the user experience

- Highest onboarding conversion

As a partner you can simply create an underlying merchant using the minimal requirements: their emailaddress and phonenumber.

Once a new merchant has been created you will receive a Merchant UID which is the unique identifier for this user. You will need to save the Merchant UID and use it to, amongst other things, create transactions for this merchant.

How will payouts work for this merchant?

After creating a merchant, it is immediately possible to start a transaction. Transactions can be created and successfully paid to a merchant of whom only the e-mail address has been verified. However funds cannot be paid out to the merchant until they have successfully finished the onboarding process and its compliance requirements.

- Read more about payouts

- Read how to onboard a Consumer Merchant with our Seamless onboarding

- Read how to onboard a Business Merchant with Seamless onboarding

Merchant Onboarding

Every user who sells a product or service and is earning money while doing this, needs to be onboarded as a merchant. This can either be a business, or consumer. We will seperate both flows, because a business merchant requires more additional information than a consumer merchant does. Creating and onboarding merchants can be done using our Merchant API.

Consumer onboarding

For onboarding a consumer merchant we offer a tiered verification process (Low KYC and High KYC). Low KYC means that only a verified bank account is needed in order to be able to receive payouts. The standard thresholds for Low KYC merchants are € 250,- in one transaction or € 1.500,- in lifetime volume. If one of these thresholds is reached the consumer is required to identify him- or herself before payouts can be reactivated. The threshold can be adjusted based on the risk profile and assessment of the platform or marketplace.

As soon as a merchant is created, you can start doing transactions. As a partner, you are in charge of when the merchant fulfills the verification requirements. In many cases the partner wants the merchant to perform the least number of actions as possible in the beginning, but in some cases the partner may wish to force the consumer to perform all KYC steps before transactions can be started. Both options are possible, and completely up to you.

The four steps of consumer merchant creation are:

- Create a consumer merchant.

- Create a

bank_account. - Verify consumer bank account (Low KYC).

- Consumer ID verification (High KYC).

1. Create a consumer merchant

1.1 Example request

POST https://api-sandbox.onlinebetaalplatform.nl/v1/merchants

{

"country": "nld",

"emailaddress": "email@domain.com",

"phone": "0612345678",

"notify_url": "https://platform.com/notify"

}

The example request allows you to create a consumer merchant.

The minimal required fields are: country, emailaddress, phone and notify_url.

The emailaddress is our unique identifier. You cannot create multiple merchants with the same email address.

Please note that the phonenumber is not required by the API. You are free to leave this out when creating the merchant, but the merchant will need to provide the phonenumber in a later stage. See 5. Fulfill other requirements.

The notify_url is the webhook URL used by OPP for notifications of status changes.

1.2. Example response

{

"uid": "{{merchant_uid}}",

"object": "merchant",

"created": 1554113700,

"updated": 1554113700,

"status": "pending",

"compliance": {

"level": 100,

"status": "verified",

"overview_url": "https://sandbox.onlinebetaalplatform.nl/en/{{partner_slug}}/{{merchant_uid}}/{{hash}}/overview",

"requirements": []

},

"type": "consumer",

...

}

As a partner you will receive the Merchant Object with compliance.level

100 as a response.

Please note, in case you decided together with your Implementation manager on a different compliance level when creating merchants, this might differ for you.

1.3. Actions

The merchant object contains three fields that you will need to save in your database:

merchant_uid- The Merchant UID, this is the unique identifier of the created merchant.status- The merchant account status.compliance.status- The compliance status of the merchant. This status will define whether the merchant will be able to receive payouts.

Ofcourse, other values can be saved in your database as well, if that is preferred by you. However, these three values are important for the flows in your platform.

After the creation of the merchant, it is immediately possible as a partner to create transactions for this merchant. The funds of the paid transactions cannot (yet) be paid out because the merchant does not yet have a linked bank account.

2. Create a bank account - Consumer

2.1 Example request

POST https://api-sandbox.onlinebetaalplatform.nl/v1/merchants/{{merchant_uid}}/bank_accounts

{

"return_url": "https://platform.example.com/return",

"notify_url": "https://platform.example.com/notify"

}

With this request you can create an 'empty' bank account for the merchant.

This 'empty' bank account serves as a container that needs to be filled with verified bank account information.

The bank account is created with a status of new and needs to be verified by the merchant.

2.2. Example response

{

"uid": "{{bank_account_uid}}",

"object": "bank_account",

"created": 1554200096,

"updated": 1554200096,

"verified": null

"verification_url": "https://onlinebetaalplatform.nl/nl/

{{partner_name}}/merchants/{{merchant_uid}}/verificatie/

bankgegevens/{{bank_account_uid}}/7a8d3c308b0739ef96320720017d070533912548",

"status": "new",

"account": {

"account_iban": null

},

"bank": {

"bic": null

},

"reference": null,

"return_url": "https://platform.example.com/return",

"notify_url": "https://platform.example.com/notify",

"is_default": true

}

As soon as a bank account has been created for the merchant, the compliance.level of the merchant will immediately be increased to 200.

You will receive the merchant.compliance_level.changed notification of this change on the merchant's specified notify_url.

Because the level has been increased, you can now also find the bank_acount.verification.required within the compliance.requirements. The verification_url that can be found in the response of the bank_account object is the same URL that is detailed in the compliance requirement.

2.3. Actions

Redirect the merchant to the verification_url.

Optionally, you can save the UID and verification_url in your database.

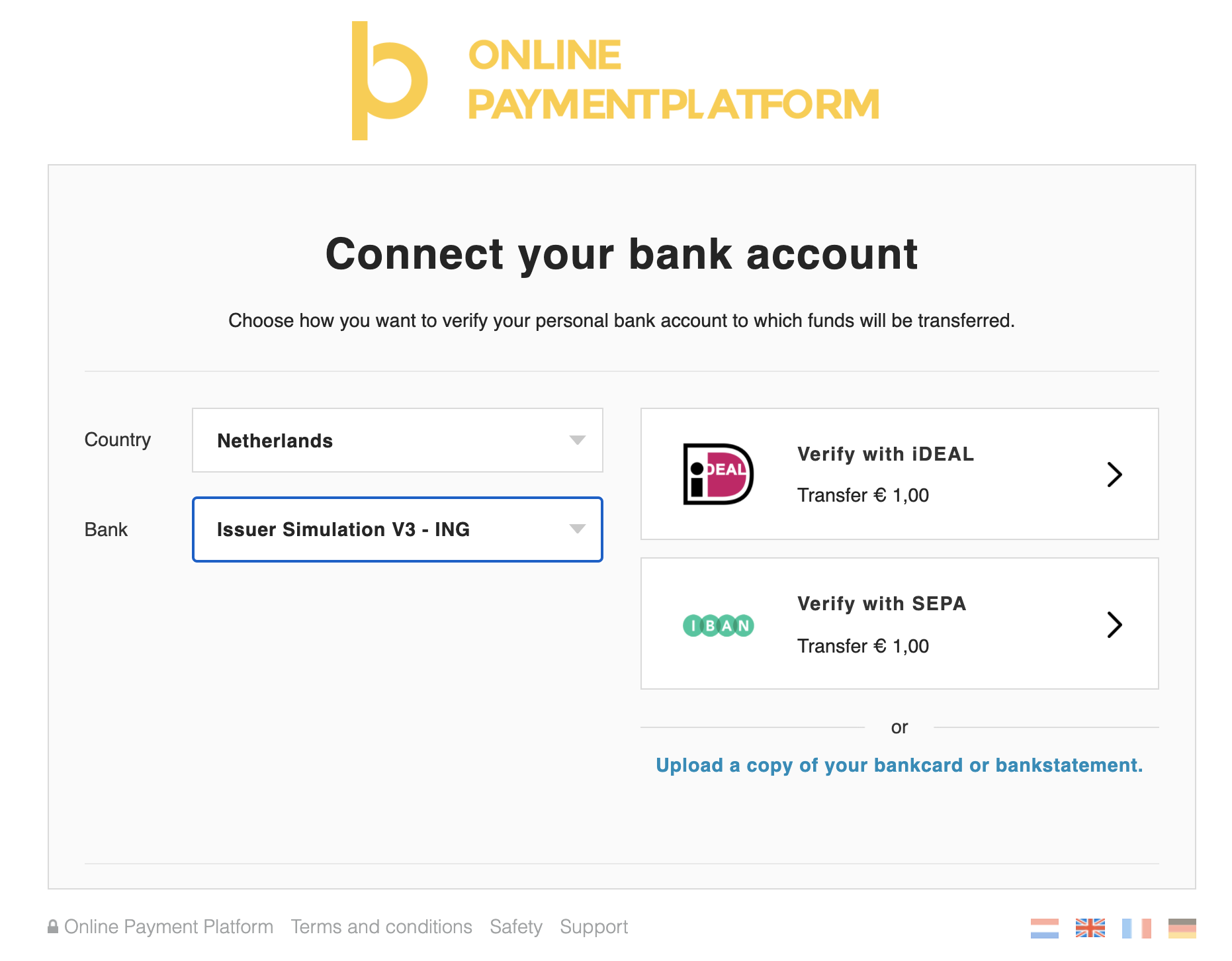

3. Verify consumer bank account

In the previous step we created an 'empty' bank account for the consumer merchant. To verify the bank account, we can follow five routes:

- Use the compliance overview_url.

- Use the verification_url.

- Use the seamless bank integration.

- Verify using the Files API.

- Perform a transaction (buyer onboarding).

In all cases OPP will send a notification right after the verification took place. The compliance requirement bank_account.verification.required and the bank

account status will be pending until OPP has performed a compliance check.

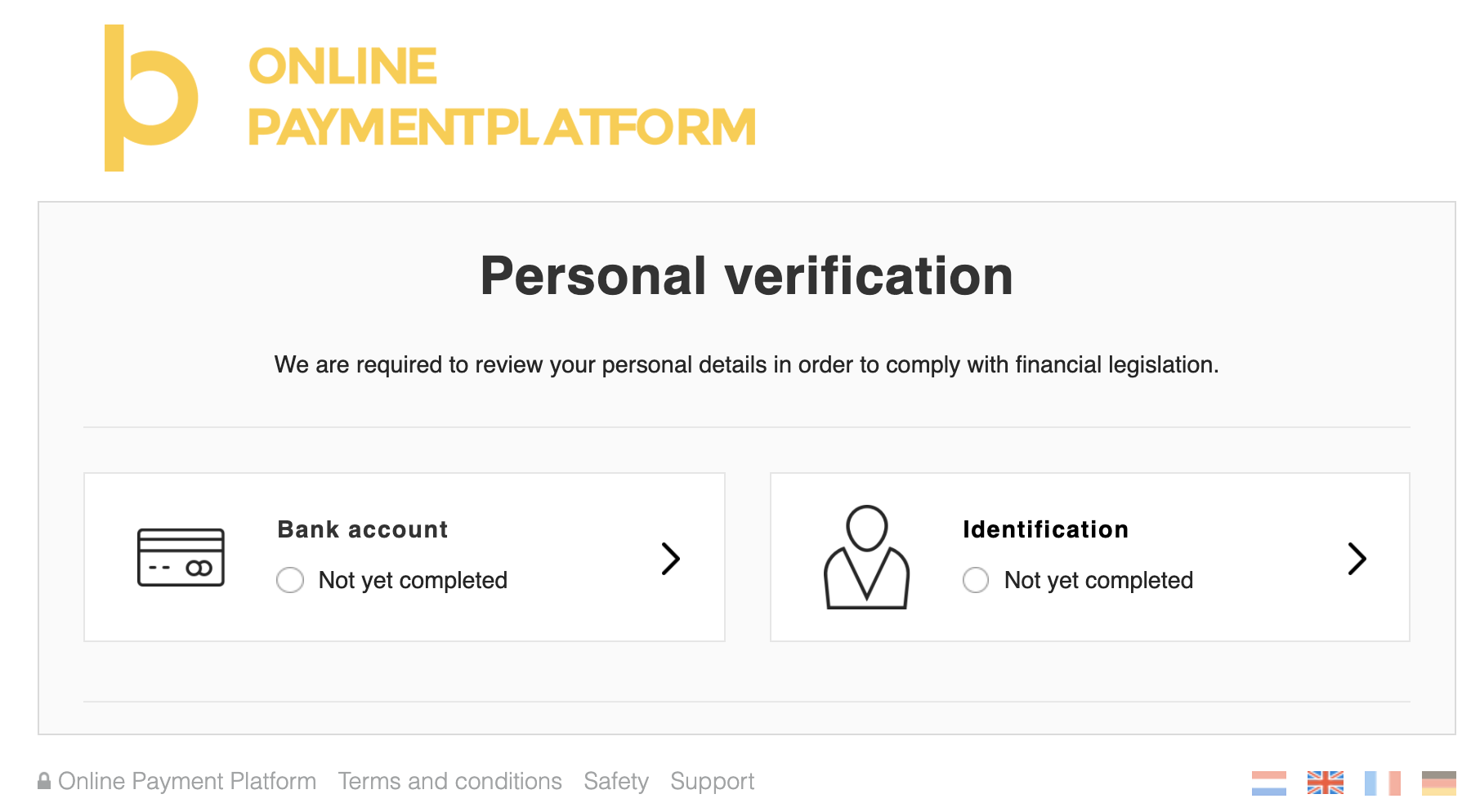

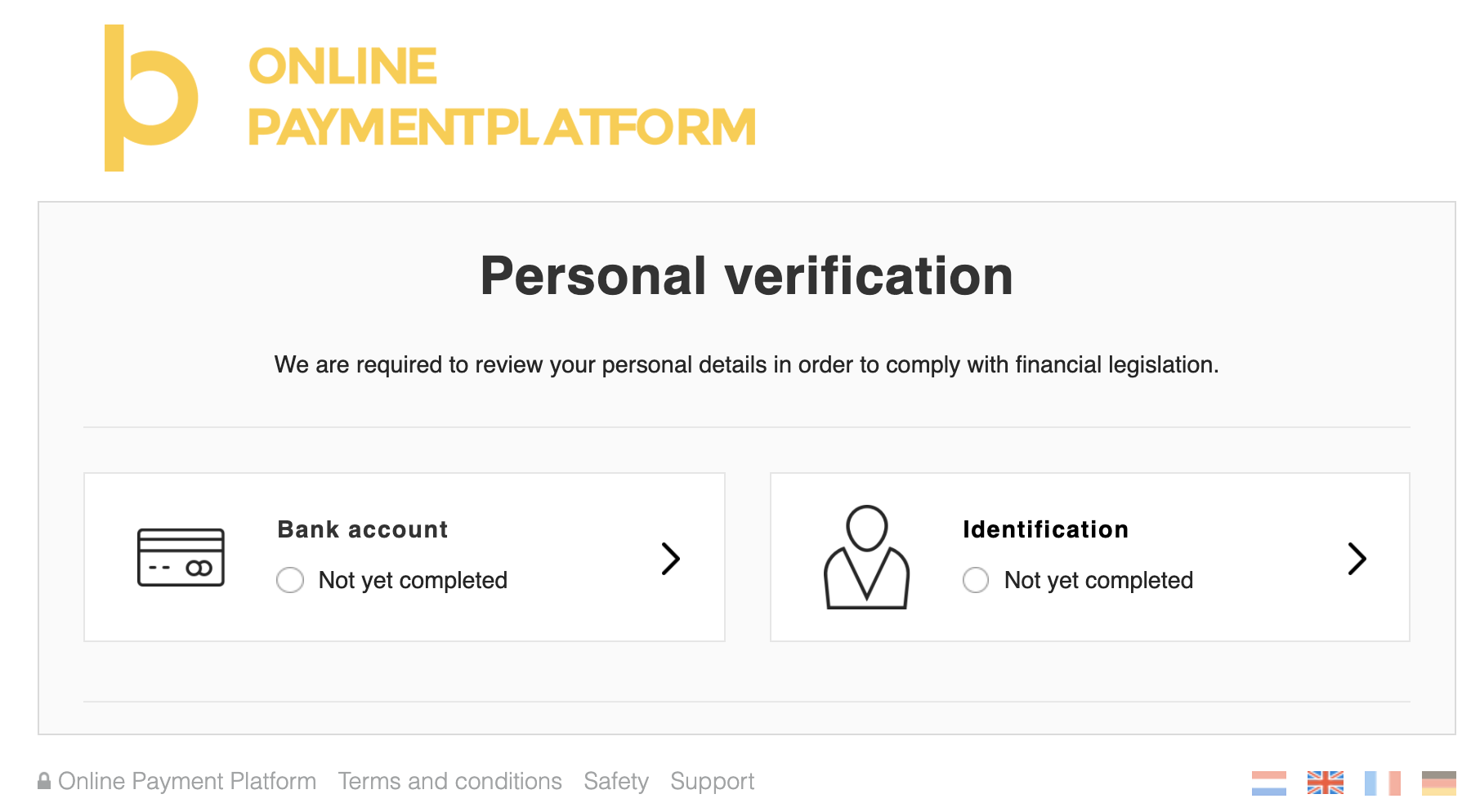

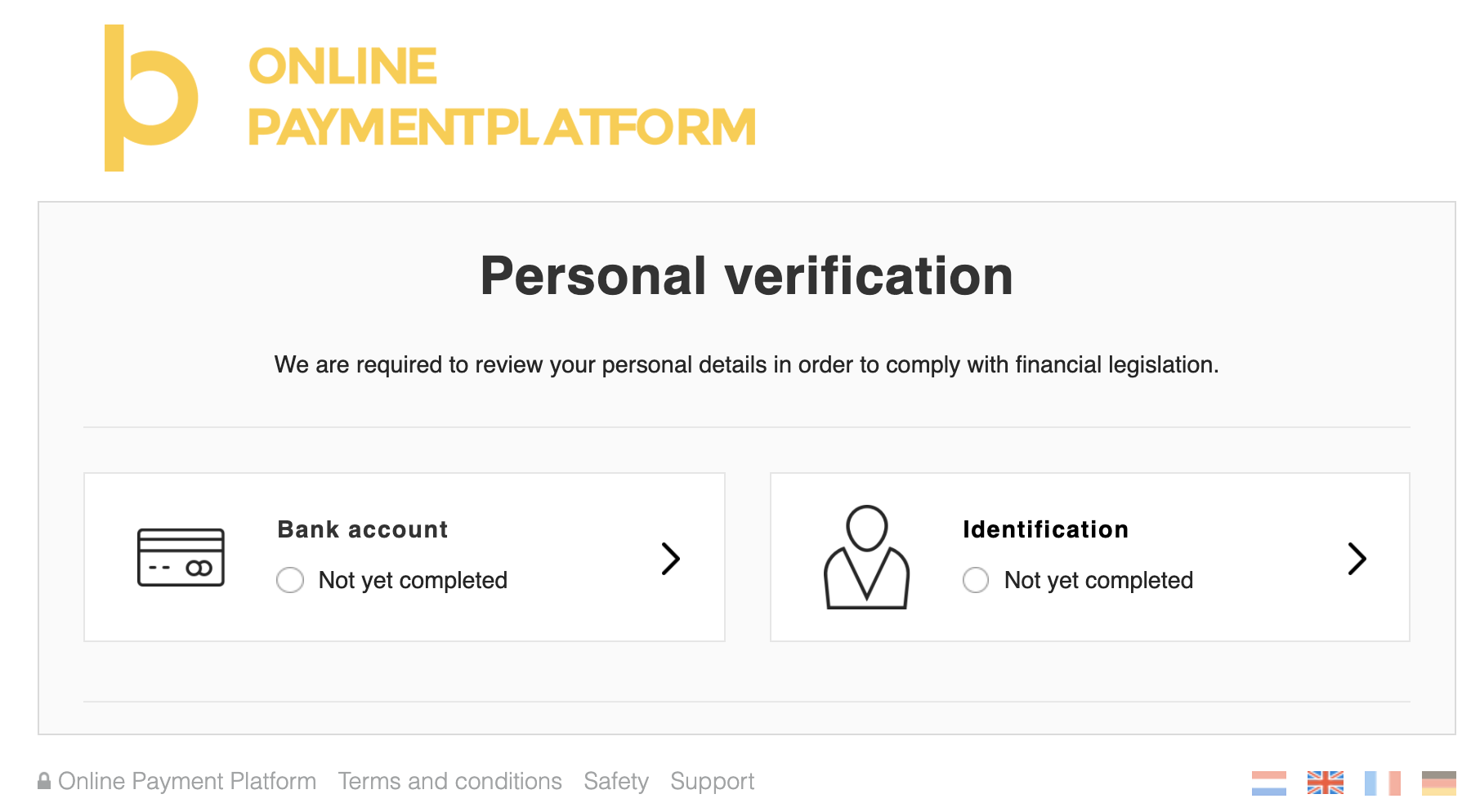

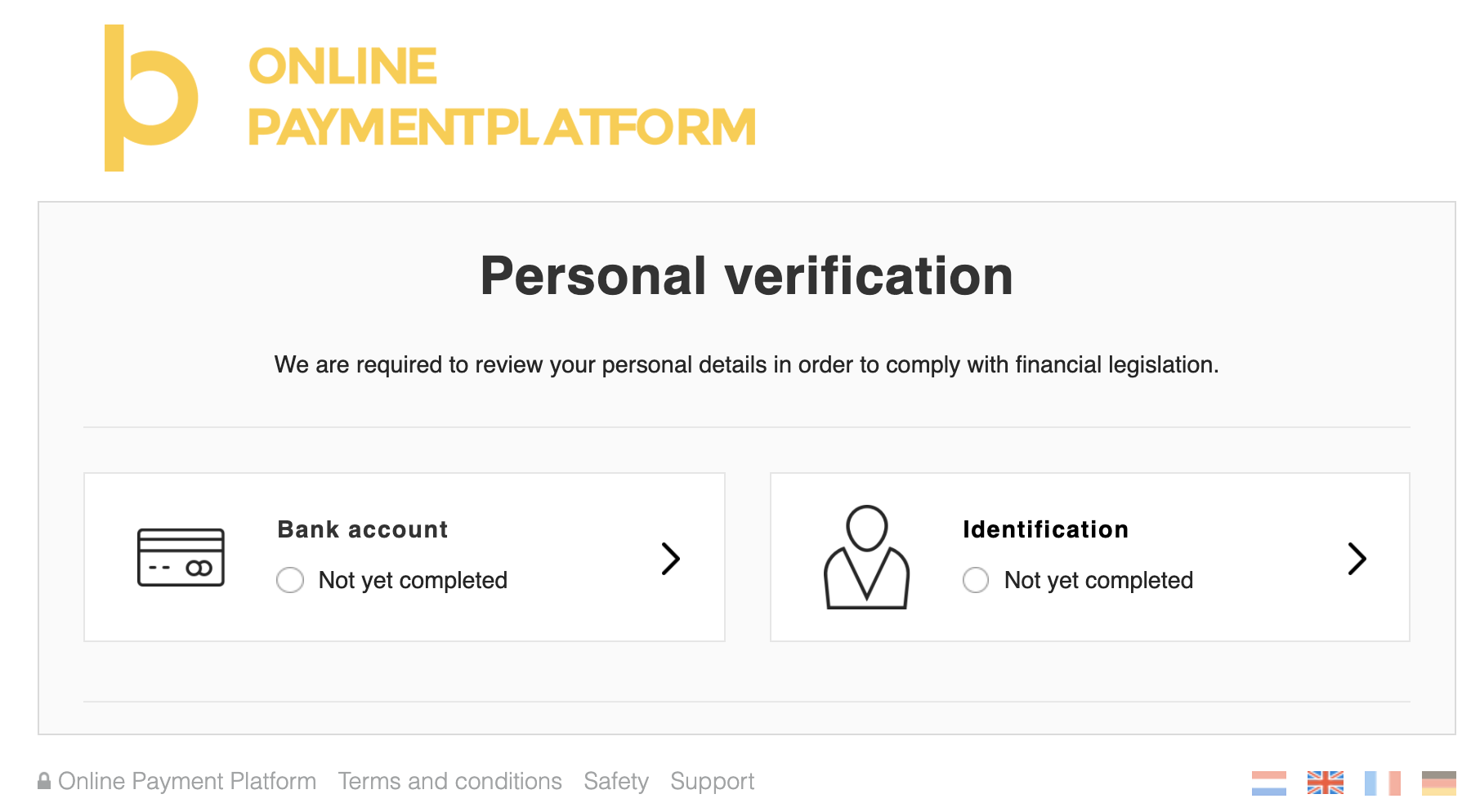

3.1. Verify the bank account by redirecting the merchant to the compliance overview_url

You can find the overview_url in the merchant compliance object. Find the overview_url in the compliance object within the merchant and redirect the user to this url.

{

"uid": "{{merchant_uid}}",

"object": "merchant",

...

"compliance": {

"level": 200,

"status": "unverified",

"overview_url": "https://sandbox.onlinebetaalplatform.nl/en/{{partner_slug}}/{{merchant_uid}}/15c0bdb17283475ec5f274cad0a2a0245dda11ff/overview",

"requirements": [

{

"type": "bank_account.verification.required",

"status": "unverified",

"object_type": "bank_account",

"object_uid": "{{bank_account_uid}}",

"object_url": "https://api-sandbox.onlinebetaalplatform.nl/v1/merchants/{{merchant_uid}}/bank_accounts/{{bank_account_uid}}",

"object_redirect_url": "https://sandbox.onlinebetaalplatform.nl/nl/{{partner_name}}/merchants/{{merchant_uid}}/verificatie/bankgegevens/{{bank_account_uid}}/7a8d3c308b0739ef96320720017d070533912548"

}

]

},

...

}

An example of this url can be found below.

3.2. Verify the bank account by redirecting the merchant to the verification_url.

You can find the verification_url in two places: the bank_account object, and the merchant compliance.requirements.

3.2.1. Bank account object

Find the verification_url and redirect the merchant to this link to verify the bank account.

{

"uid": "{{bank_account_uid}}",

"object": "bank_account",

"created": 1554200096,

"updated": 1554200096,

"verified": null

"verification_url": "https://onlinebetaalplatform.nl/nl/{{partner_name}}/merchants/{{merchant_uid}}/verificatie/bankgegevens/{{bank_account_uid}}/7a8d3c308b0739ef96320720017d070533912548",

"status": "new",

...

}

3.2.2. Merchant compliance requirements

Find the requirement with type bank_account.verification.required and redirect the merchant to the object_redirect_url.

{

"uid": "{{merchant_uid}}",

"object": "merchant",

...

"compliance": {

"level": 200,

"status": "unverified",

"overview_url": "https://sandbox.onlinebetaalplatform.nl/en/{{partner_slug}}/{{merchant_uid}}/15c0bdb17283475ec5f274cad0a2a0245dda11ff/overview",

"requirements": [

{

type": "bank_account.verification.required",

"status": "unverified",

"object_type": "bank_account",

"object_uid": "{{bank_account_uid}}",

"object_url": "https://api-sandbox.onlinebetaalplatform.nl/v1/merchants/{{merchant_uid}}/bank_accounts/{{bank_account_uid}}",

"object_redirect_url": "https://sandbox.onlinebetaalplatform.nl/nl/{{partner_name}}/merchants/{{merchant_uid}}/verificatie/bankgegevens/{{bank_account_uid}}/7a8d3c308b0739ef96320720017d070533912548"

}

]

},

...

}

An example of this url can be found below.

3.3. Verify bank seamlessly by redirecting merchant directly to bank / payment method.

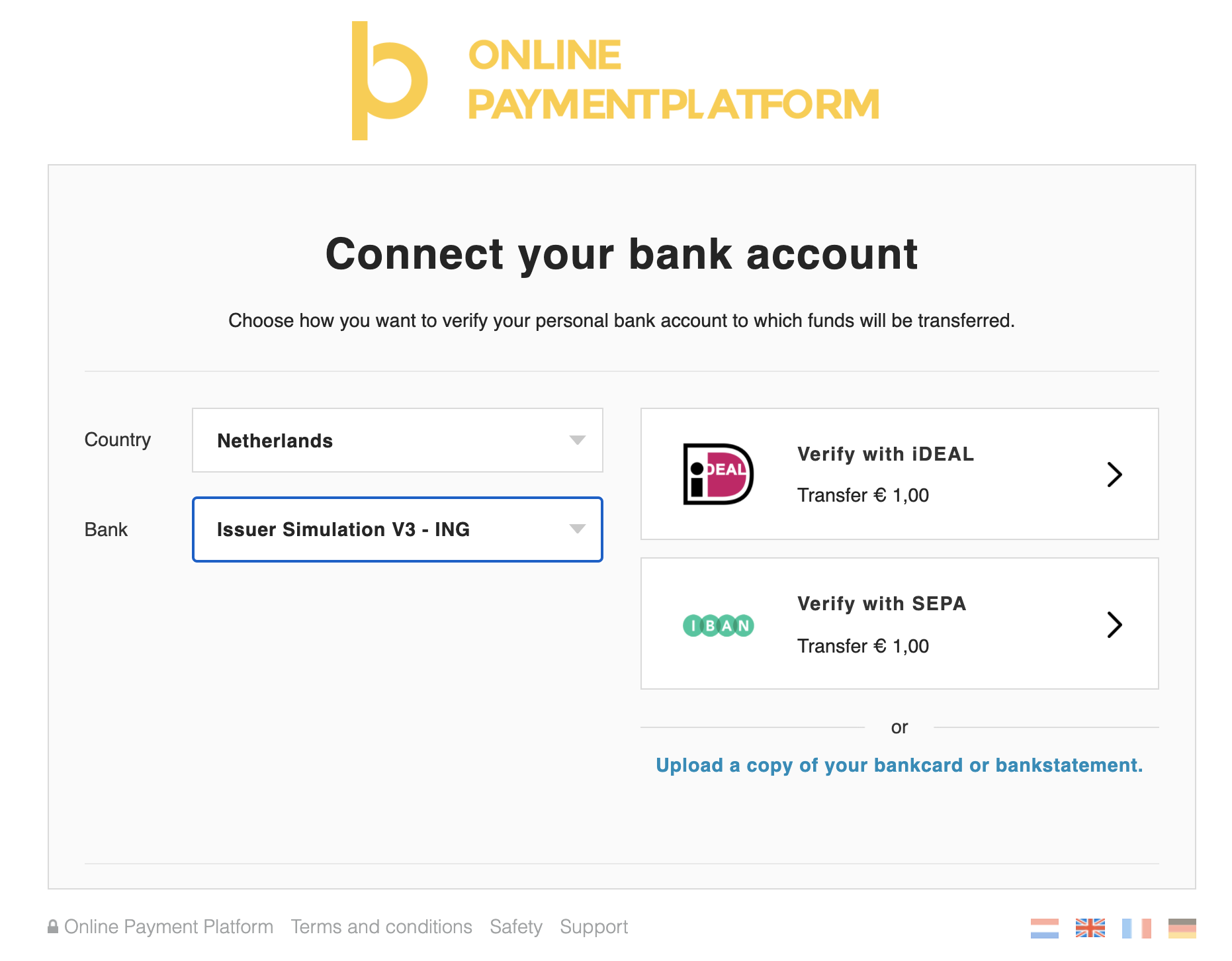

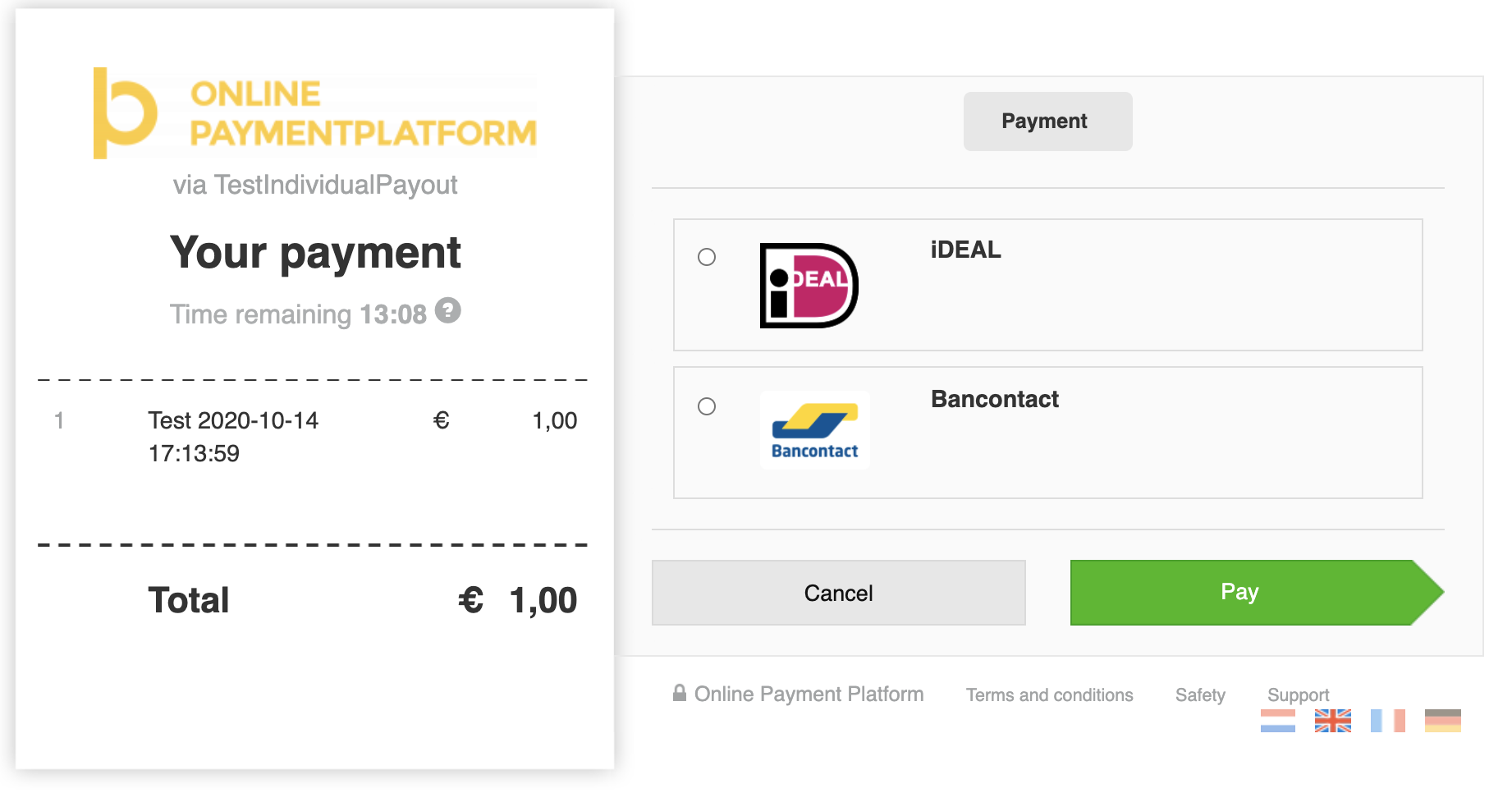

In case of Belgium and The Netherlands, we provide a direct link with Bancontact and iDEAL, providing a seamless integration, so that merchants do not see our bank verification screen.

To do this, first find the verification_url by using one of the methods in 3.2.

After that, append additional parameters to the url. Then redirect the user to the new url.

| Additional parameters | |

| payment_method | one of ideal or bcmc |

| issuer | required if payment_method is ideal, one of the SWIFT codes of the iDEAL issuers list. |

https://onlinebetaalplatform.nl/nl/{{partner}}/merchants/{{merchant_uid}}/

verificatie/bankgegevens/

{{bank_account_uid}}/{{hash}}?payment_method=ideal&issuer=INGBNL2A

3.4. Verify using the Files API.

If you wish to create a seamless and smoother user experience while making sure the merchants upload their files without you having to process any sensitive data, then you can rely on the Files API to send us all documents necessary to do the KYC. This consists out of two steps.

3.4.1. Create a one time File Link

You first need to send a POST request to the Files upload endpoint and specify in the parameters the purpose of the file, ‘bank_account_bank_statement’ and provide the UID for which the upload is to be used.

POST https://files-sandbox.onlinebetaalplatform.nl/v1/uploads

{

"purpose": "bank_account_bank_statement",

"merchant_uid": "{{merchant_uid}}",

"object_uid": "{{bank_account_uid}}"

}

That leads to the following response:

{

"uid": "{{file_uid}}",

"created": "1606003200",

"updated": "1606003200",

"expired": "1606004100",

"merchant_uid": "{{merchant_uid}}",

"object_uid": "{{bank_account_uid}}",

"purpose": "bank_account_bank_statement",

"token": "{{token}}",

"url": "https://files-sandbox.onlinebetaalplatform.nl/v1/uploads/{{file_uid}}"

}

3.4.2. Upload the file

In order to finish the operation, you need to send the file via a POST request to the endpoint https://api-sandbox.onlinebetaalplatform.nl/v1/{{file_uid}}.

In the headers of this request, you need to provide the token you previously stored in the field x-opp-files-token and the file in a FILE parameter.

POST https://files-sandbox.onlinebetaalplatform.nl/v1/uploads/{{file_uid}}

Headers

{

"x-opp-files-token": "{{token}"

}

Parameters

{

"file": "{{file}}"

}

3.5. Verify the bank account by performing a transaction.

OPP also supports the ability to verify a merchant's bank account when the merchant itself completes a transaction to another merchant.

This can for example be used to perform buyer onboarding, when the buyer will be a seller at the platform as well. Another case is when you as a platform want to have a dynamic onboarding fee, that differs per merchant. In that case, the {{seller_merchant_uid}} will be your platform merchant.

If the merchant does not yet exist, create a merchant and an 'empty' bank account for this merchant first. This allows you to set the right notify_url and other details. Do note that you do not have to redirect merchant to the bank_account verification_url. You may pass this new merchant's uid as a parameter to the Create Transaction API call using parameter verification_merchant_uid to verify the bank account via this transaction.

POST https://api-sandbox.onlinebetaalplatform.nl/v1/transactions

{

"merchant_uid": "{{seller_merchant_uid}}",

"products": [

{

"name": "Test",

"price": 100,

"quantity": 1

}

],

"return_url": "https://platform.example.com/return/",

"notify_url": "https://platform.example.com/notify/",

"total_price": 100,

"verification_merchant_uid": "{{buyer_merchant_uid}}",

"metadata":

{

"external_id": "2015486"

}

}

The bank account will stay in a new state if this transaction is not successfully completed and will change to state pending if transaction is successfully completed, just like the regular bank account verification flow.

Process of the approval OR disapproval

The compliance team of OPP checks all new or updated verifications within 24 hours on working days and will either approve or disapprove the verification. Notifications are sent as soon as OPP has approved or disapproved the bank account.

{

"uid": "{{notification_uid}}",

"type": "merchant.compliance_status.changed",

"created": 1619182391,

"object_uid": "{{merchant_uid}}",

"object_type": "merchant",

"object_url": "https://api-sandbox.onlinebetaalplatform.nl/v1/merchants/{{merchant_uid}}",

"verification_hash": "{{hash}}"

}

{

"uid": "{{notification_uid}}",

"type": "bank_account.status.changed",

"created": 1619182670,

"object_uid": "{{bank_account_uid}}",

"object_type": "bank_account",

"object_url": "https://api-sandbox.onlinebetaalplatform.nl/v1/merchants/{{merchant_uid}}/bank_accounts/{{bank_account_uid}}",

"parent_uid": "{{merchant_uid}}",

"parent_type": "merchant",

"parent_url": "https://api-sandbox.onlinebetaalplatform.nl/v1/merchants/{{merchant_uid}}",

"verification_hash": "{{hash}}"

}

Approved:

The bank account information has been approved and has received the status approved. The compliance requirement

bank_account.verification.required has received the status verified and will no longer be visible within the merchant.compliance.requirements.

| Sent notifications | |

|

merchant.compliance_requirement.

status pending > verified

bank_account.status.

status pending > approved

|

|

If the merchant has no other unverified or pending compliance.requirements, then merchant's

compliance.status shall be updated from pending to verified. This change in status will also be sent by the

following notification merchant.compliance_status.changed.

- OR -

Disapproved:

The bank account information has been disapproved and has received the status disapproved. The compliance requirement bank_account.verification.required has received the status unverified.

Merchant is required to verify its bank details again, see step 3.1.

| Sent notifications | |

|

merchant.compliance_requirement.

status pending > unverified

bank_account.status.

status pending > disapproved

|

|

If the merchant's compliance.status was pending, this will be changed to unverified. This change in status will also be sent

by the following notification merchant.compliance_status.changed.

Actions

Retrieve the new status after the notification was sent, and adjust this status in your database.

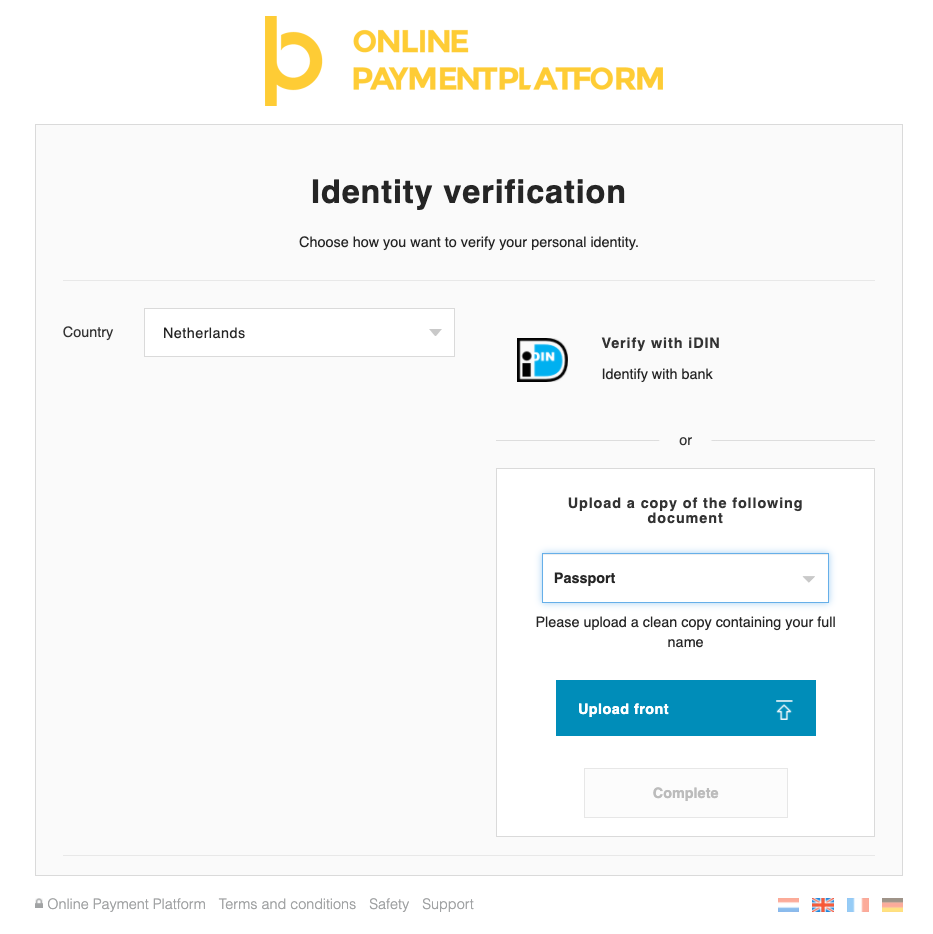

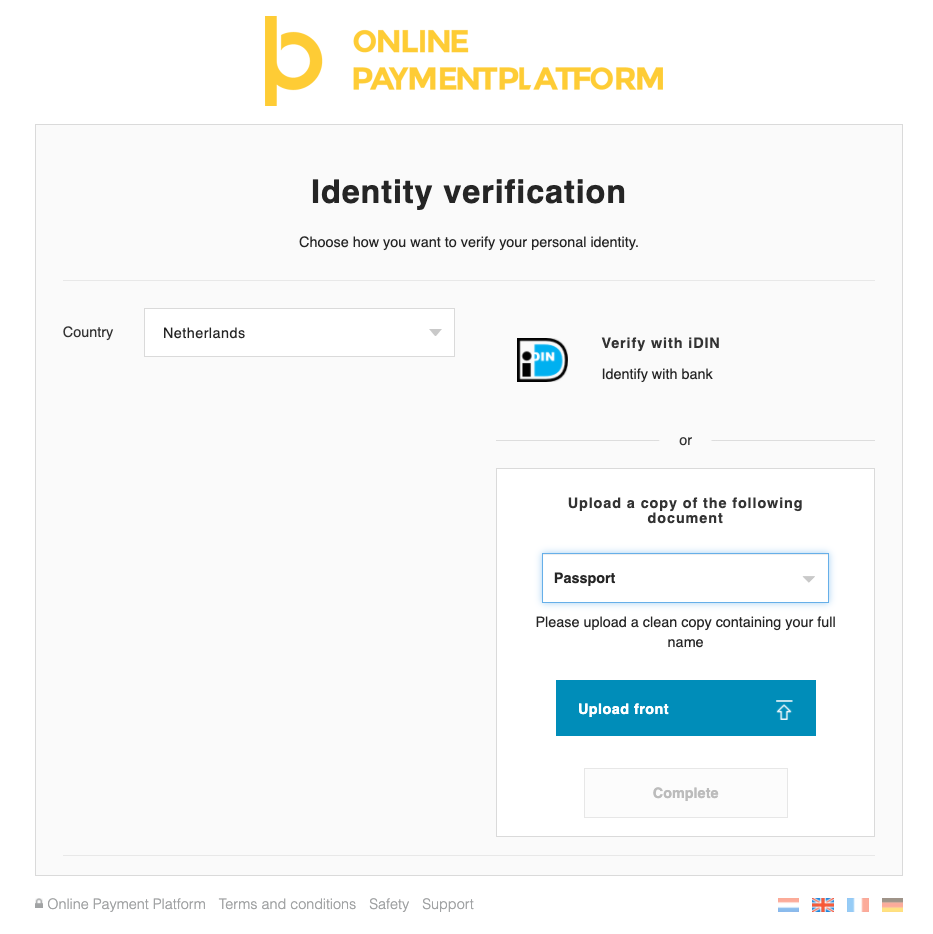

4. Verify consumer identity

As a partner, you are free to decide at what moment in time you would like your merchants to complete their identity verification. We distinguish two different paths to do this:

- The merchant has not yet reached compliance level 400.

- The merchant has reached compliance level 400.

In both cases, identification provided must contain the same name as the bank account holder name.

4.1. The merchant has not yet reached compliance level 400.

As long as the merchant has not yet reached a compliance level of 400, the identity verification is not obliged by OPP.

In case you would want to already fulfill the contact verification, you can do so by using the verification_url in the merchant.contact object.

GET https://api-sandbox.onlinebetaalplatform.nl/v1/merchants/{{merchant_uid}}?expand[]=contacts

{

"livemode": false,

"uid": "{{merchant_uid}}",

"object": "merchant",

...

"contacts": [

{

"uid": "con_59c4c3b3493d",

"object": "contact",

"created": 1604404358,

"updated": 1604404358,

"verified": null,

"status": "unverified",

"verification_url": "https://sandbox.onlinebetaalplatform.nl/en/{{partner_slug}}/merchants/{{merchant_uid}}/verifications/contact-details/{{contact_uid}}/273db5ea58b3ce0fb061608054f32efd258b954d",

"type": "representative",

"title": null,

"name_initials": null,

"name_first": null,

"name_last": null,

"names_given": null,

"birthdate": null,

"partner_name_last": null,

"emailaddresses": [],

"phonenumbers": []

}

],

...

}

After verification, the merchant will be updated, and the platform will receive the notifications that go with these updates. The compliance level will raise to 400 only when the ID verification gets verified. When you upload the ID card, and the contact status is pending, the compliance level will remain 200. Also when we disapprove the ID verification, the compliance level will remain 200.

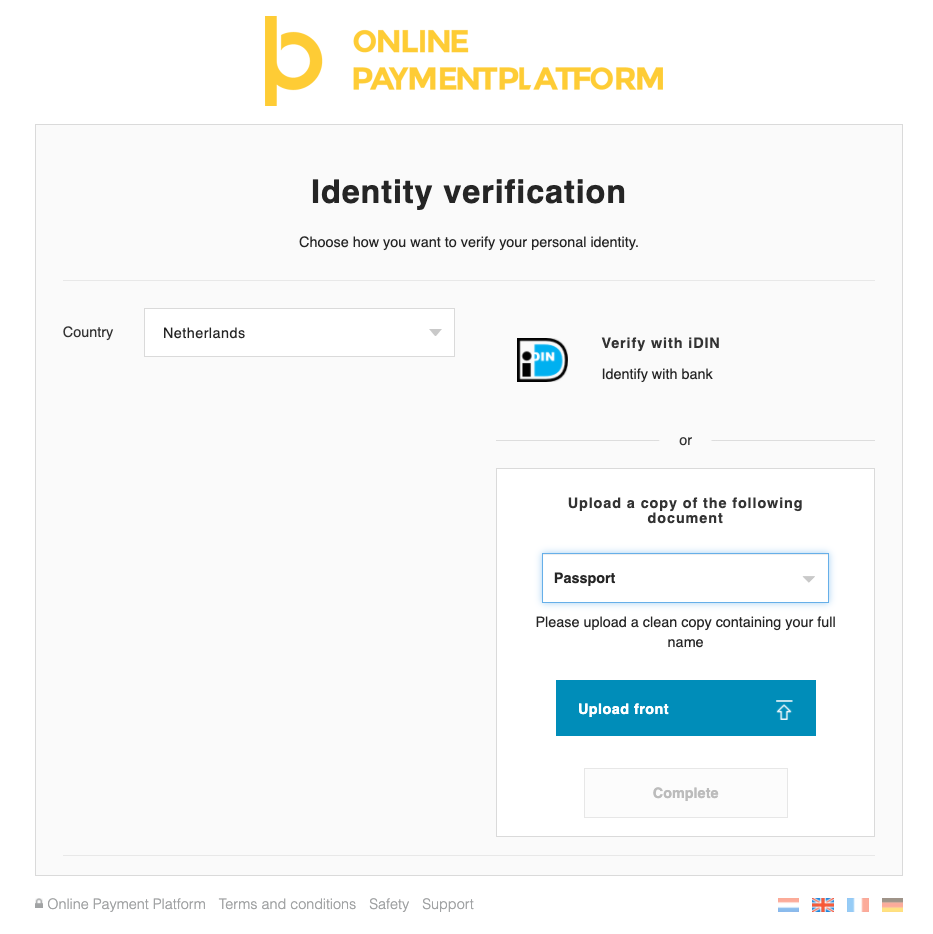

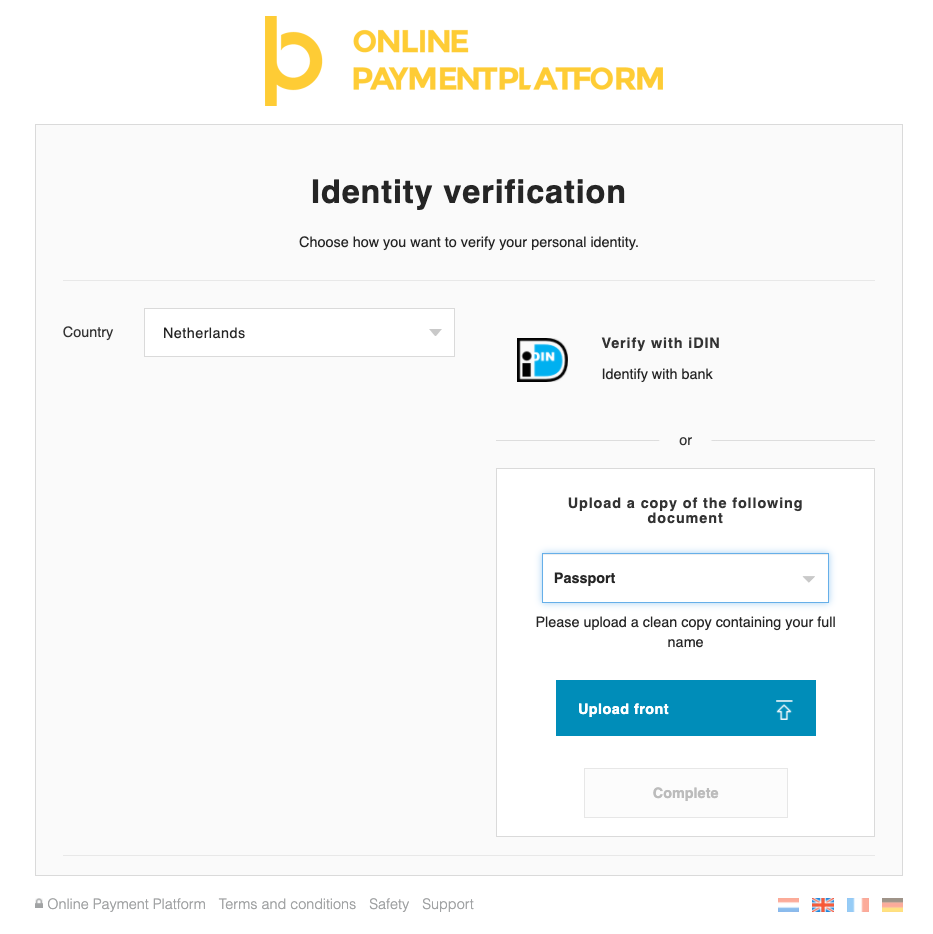

An example of the verification url can be found below.

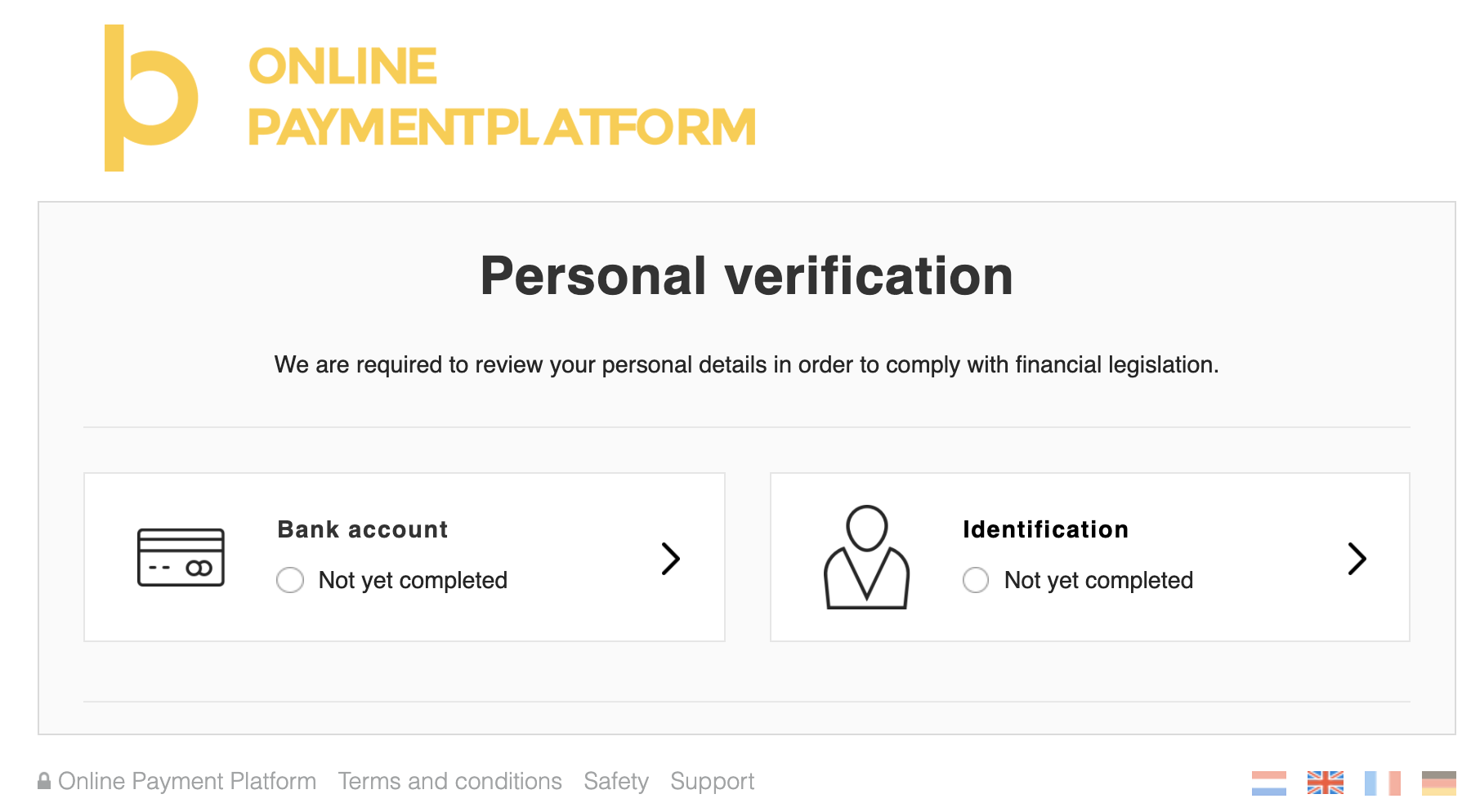

4.2. The merchant has reached compliance level 400.

Once the compliance.level of the merchant has reached 400, identity verification is required. There are four ways to provide OPP this identity. You can

- Use the

verification_urlas used in 4.1. - Use the compliance overview_url.

- Redirect the merchant to the white-label

object_redirect_url. - Verify the identification seamlessly by redirecting directly to a local identification method (such as iDIN or itsme).

- Verify using the Files API.

4.2.2. Redirect merchant to compliance overview_url.

You can find the overview_url in the merchant compliance object. Find the overview_url in the compliance object within the merchant and redirect the user to this url.

{

"uid": "{{merchant_uid}}",

"object": "merchant",

...

"compliance": {

"level": 200,

"status": "unverified",

"overview_url": "https://sandbox.onlinebetaalplatform.nl/en/{{partner_slug}}/{{merchant_uid}}/15c0bdb17283475ec5f274cad0a2a0245dda11ff/overview",

"requirements": [

...

]

},

...

}

OPP will send a notification immediately after the identification took place. The compliance.requirement contact.verification.required and the contact status will be pending until OPP performed a compliance check.

An example of this url can be found below.

4.2.3. Redirect merchant to white-label object_redirect_url.

Within the Merchant Object you will find the compliance requirement contact.verification.required.

Find the object_redirect_url and redirect the merchant to this url to identify him/herself.

Note that this is the same url as the verification_url of 4.1.

{

"uid": "{merchant_uid}",

"object": "merchant",

...

"compliance": {

"level": 400,

"status": "unverified",

"overview_url": "https://sandbox.onlinebetaalplatform.nl/en/{{partner_slug}}/{{merchant_uid}}/e1e477f8c7e6e688c8c752e5e7a4bad448f52a67/overview"

"requirements": [

{

"type": "contact.verification.required",

"status": "unverified",

"object_uid": {{contact_uid}},

"object_type": "contact",

"object_url": "https://api-sandbox.onlinebetaalplatform.nl/v1/merchants/...",

"object_redirect_url": https://sandbox.onlinebetaalplatform.nl/...

}

]

},

...

}

OPP will send a notification immediately after the identification took place. The compliance.requirement contact.verification.required and the contact status will be pending until OPP performed a compliance check.

4.2.4. Seamlessly identify merchant by redirecting directly to a local idenfication method.

You can skip the whitelabel screens and immediately redirect the user to a local identification method if this is available in your country. Doing this requires three steps:

- Find the

object_redirect_urlorverification_urlas mentioned earlier. - Add the additional parameters as described below to the url.

- Redirect the merchant to the adapted url.

| Additional parameters | |

| verification_type | One of idin or itsme |

| issuer | required if verification_type is idin, one of the SWIFT codes of the

iDIN issuers list. |

https://onlinebetaalplatform.nl/nl/{{partner}}/merchants/{{merchant_uid}}/

verificatie/contactgegevens

/{{contact_uid}}/{{hash}}?verification_type=idin&issuer=INGBNL2A

4.2.5. Verify using the Files API.

If you wish to create a seamless and smoother user experience while making sure the merchants upload their files without you having to process any sensitive data, then you can rely on the Files API to send us all documents necessary to do the KYC. This consists out of two steps.

4.2.5.1. Create a one time File Link

You first need to send a POST request to the Files upload endpoint and specify in the parameters the purpose of the file, ‘representative_passport’ and provide the UID for which the upload is to be used.

POST https://files-sandbox.onlinebetaalplatform.nl/v1/uploads

{

"purpose": "representative_passport",

"merchant_uid": "{{merchant_uid}}",

"object_uid": "{{contact_uid}}"

}

That leads to the following response:

{

"uid": "{{file_uid}}",

"created": "1606003200",

"updated": "1606003200",

"expired": "1606004100",

"merchant_uid": "{{merchant_uid}}",

"object_uid": "{{contact_uid}}",

"purpose": "representative_passport",

"token": "{{token}}",

"url": "https://files-sandbox.onlinebetaalplatform.nl/v1/uploads/{{file_uid}}"

}

4.2.5.2. Upload the file

In order to finish the operation, you need to send the file via a POST request to the endpoint https://api-sandbox.onlinebetaalplatform.nl/v1/{{file_uid}}.

In the headers of this request, you need to provide the token you previously stored in the field x-opp-files-token and the file in a FILE parameter.

POST https://files-sandbox.onlinebetaalplatform.nl/v1/uploads/{{file_uid}}

Headers

{

"x-opp-files-token": "{{token}"

}

Parameters

{

"file": "{{file}}"

}

OPP will send a notification immediately after the identification took place. The compliance.requirement contact.verification.required

and the contact status will be pending until OPP performed a compliance check.

Process of the approval OR disapproval

The compliance team of OPP checks all new or updated verifications within 24 hours on working days and will either approve or disapprove the verification. Notifications are sent as soon as OPP has approved or disapproved the identification.

Approved:

The identification has been approved and has received the status verified. The compliance requirement contact.verification.required

has been updated with the status verified and is no longer visible within the merchant.compliance.requirements.

| Sent notifications | |

|

merchant.compliance_requirement.

status pending > verified

contact.status.

status pending > verified

|

|

If the merchant has no other unverified or pending compliance.requirements, merchant's

compliance.status will be updated from pending to verified. This change in status will

also be sent by the following notification merchant.compliance_status.changed.

- OR -

Disapproved:

The identification has been disapproved and has received the status unverified. The compliance requirement contact.verification.required

has been updated with the status unverified. The merchant is required to identify itself again, see step 1.

| Sent notifications | |

|

merchant.compliance_requirement.

status pending > unverified

contact.status.

status pending > unverified

|

|

If the merchant's compliance.status was pending, this will be updated to unverified. This change in status will also be sent by the

following notification merchant.compliance_status.changed.

5. Fulfill other requirements

A business merchant might have several other compliance requirements to fulfill:

- Contact phone verification.

5.1. Contact phone verification

Once the merchant is created, you will find the contact.phonenumber.required requirement. OPP needs to have a phonenumber that belongs to the merchant. We are legally bound to have a verified phonenumber and email address from every merchant, in order to contact him/her when something is wrong with a transaction or verification.

You as a partner have to deal with the verification of an email address before creating the merchant.

For phone number verification, OPP provides the choice to do it yourself, or let us do the phonenumber verification.

"uid": "{{merchant_uid}}",

"object": "merchant",

...

"compliance": {

"level": 100,

"status": "unverified",

"overview_url": "https://sandbox.onlinebetaalplatform.nl/en/{{partner_slug}}/{{merchant_uid}}/feabfd98b2a9d246a6e33742f92af061059b9f81/overview",

"requirements": [

{

"type": "contact.phonenumber.required",

"status": "unverified",

"object_type": "contact_phonenumber",

"object_uid": null,

"object_url": null,

"object_redirect_url": "https://sandbox.onlinebetaalplatform.nl/en/{{partner_slug}}/merchants/{{merchant_uid}}/verifications/phonenumber-form/{{contact_uid}}/feabfd98b2a9d246a6e33742f92af061059b9f81"

}]

...

If you prefer to do verification yourself, you can choose to do this at the very beginning, before creating a merchant at our side, or when the merchant already exists. In the compliance requirements, find the object_redirect_url and redirect the representative of the business to this url. If you would prefer a seamless solution, you can do this by performing a POST on the contact object as can be seen on the right. Once the phonenumber is filled in, the merchant will be updated and the notifications will be send.

POST https://api-sandbox.onlinebetaalplatform.nl/v1/merchants/{{merchant_uid}}/contacts/{{contact_uid}} \

{

"phonenumbers": [

{

"phonenumber": "0612345678"

}

]

}

In case you want OPP to do the verification, you will find a object_redirect_url in the contact.phonenumber.verification.required compliance requirement. Redirect the user to this url, where (s)he can fill in the phonenumber to be verified.

A text message will be send to the phonenumber, which needs to be filled in to verify the phonenumber.

The requirement will then disappear.

Business onboarding

As a partner you can create a business merchant using the 5 steps described below. A business merchant must always complete the High KYC.

As soon as a merchant is created, you can start doing transactions. As a partner, you are in charge of when the merchant fulfills the verification requirements. In many cases the partner wants the merchant to perform the least number of actions as possible in the beginning, but in some cases the partner may wish to force the business to perform all KYC steps before transactions can be started. Both options are possible, and completely up to you.

The five steps of business merchant creation are:

- Create a business merchant.

- Create a

bank_account. - Verify business bank account.

- Business representative verification.

- Fulfill other requirements (not required in all cases).

1. Create a business merchant

1.1 Example request

With the example request shown below you can create a business merchant. As a partner you will receive the Merchant Object with compliance.level 400 as a response.

POST https://api-sandbox.onlinebetaalplatform.nl/v1/merchants

{

"type": "business",

"coc_nr": "12345678",

"country": "nld",

"emailaddress": "email@domain.com",

"phone": "0612345678",

"notify_url": "https://platform.com/notify"

}

The minimal required fields are: coc_nr, type, country, emailaddress, phone and notify_url.

The emailaddress is our unique identifier. You cannot create multiple merchants with the same email address.

Please note that the phonenumber is not required by the API. You are free to leave this out when creating the merchant, but the merchant will need to provide the phonenumber in a later stage. See 5. Fulfill other requirements.

The notify_url is the webhook URL used by OPP for notifications of status changes.

1.2. Example response

{

"uid": "{{merchant_uid}}",

"object": "merchant",

"created": 1604661043,

"updated": 1604661043,

"status": "pending",

"compliance": {

"level": 400,

"status": "unverified",

"overview_url": "https://sandbox.onlinebetaalplatform.nl/en/{{partner_slug}}/{{merchant_uid}}/{{hash}}/overview",

"requirements": [

{

"type": "bank_account.required",

"status": "unverified",

"object_type": "bank_account",

"object_uid": null,

"object_url": "https://api-sandbox.onlinebetaalplatform.nl/v1/merchants/{{merchant_uid}}/bank_accounts",

"object_redirect_url": null

},

{

"type": "contact.verification.required",

"status": "unverified",

"object_type": "contact",

"object_uid": "{{contact_uid}}",

"object_url": "https://api-sandbox.onlinebetaalplatform.nl/v1/merchants/{{merchant_uid}}/contacts/con_e9e5e1b7bd23",

"object_redirect_url": "https://sandbox.onlinebetaalplatform.nl/en/{{partner_slug}}/merchants/{{merchant_uid}}/verifications/contact-details/{{contact_uid}}/{{hash}}"

}

]

},

"type": "business",

"coc_nr": "12345678",

...

}

Within the Merchant Object you will also find the Merchant UID, this is the unique identifier of the created merchant and as a partner you will need to save the Merchant UID and use it to, amongst other things, create transactions for this merchant. It is therefore required to store the Merchant UID within your own application.

1.3. Actions

The merchant object contains three fields that you will need to save in your database:

merchant_uid- The Merchant UID, this is the unique identifier of the created merchant.status- The merchant account status.compliance.status- The compliance status of the merchant. This status will define whether the merchant will be able to receive payouts.

Ofcourse, other values can be saved in your database as well, if that is preferred by you. These three values are important for the flows in your platform.

After the creation of the merchant, it is immediately possible as a partner to create transactions for this merchant. The funds of the paid transactions cannot (yet) be paid out because the merchant still has outstanding compliance requirements.

1.3. Received notifications

Initializing a merchant will trigger some initial notifications from out the system.

| Sent notifications | |

|

merchant.compliance_requirement.status.

status pending/verified > unverified

merchant.compliance_status.

status pending/verified > unverified

|

|

There is no necessaty to follow up these notifications, but it does allow you to send an initial email towards the merchant about their outstanding compliance requirements.

2. Create a bank account - Business

2.1 Example request

POST https://api-sandbox.onlinebetaalplatform.nl/v1/merchants/{{merchant_uid}}/bank_accounts

{

"return_url": "https://platform.example.com/return",

"notify_url": "https://platform.example.com/notify"

}

With this request you can create an 'empty' bank account for the merchant.

This 'empty' bank account serves as a container that needs to be filled with verified bank account information.

The bank account is created with a status of new and needs to be verified by the merchant.

2.2. Example response

{

"uid": "{{bank_account_uid}}",

"object": "bank_account",

"created": 1554200096,

"updated": 1554200096,

"verified": null

"verification_url": "https://onlinebetaalplatform.nl/nl/

{{partner_name}}/merchants/{{merchant_uid}}/verificatie/

bankgegevens/{{bank_account_uid}}/7a8d3c308b0739ef96320720017d070533912548",

"status": "new",

"account": {

"account_iban": null

},

"bank": {

"bic": null

},

"reference": null,

"return_url": "https://platform.example.com/return",

"notify_url": "https://platform.example.com/notify",

"is_default": true

}

Now that the required bank account has been created, you will receive a notification with type merchant.compliance_requirement.status.changed.

The compliance requirement bank_account.required is set to verified, and is being replaced by bank_account.verification.required

The verification_url that can be found in the response of the bank_account object is the same URL that is detailed in the compliance requirement.

2.3. Actions

Redirect the merchant to the verification_url.

Optionally, you can save the UID and verification_url in your database.

3. Verify business bank account

In the previous step we created an 'empty' bank account for the business merchant. To verify the bank account, we can follow four routes:

- Use the compliance overview_url.

- Use the verification_url.

- Use the seamless bank integration.

- Verify using the Files API.

- Perform a transaction (buyer onboarding).

In all cases OPP will send a notification right after the verification took place. The compliance requirement bank_account.verification.required and the bank

account status will be pending until OPP has performed a compliance check.

3.1. Verify the bank account by redirecting the merchant to the compliance overview_url

You can find the overview_url in the merchant compliance object. Find the overview_url in the compliance object within the merchant and redirect the user to this url.

{

"uid": "{{merchant_uid}}",

"object": "merchant",

...

"compliance": {

"level": 400,

"status": "unverified",

"overview_url": "https://sandbox.onlinebetaalplatform.nl/en/{{partner_slug}}/{{merchant_uid}}/15c0bdb17283475ec5f274cad0a2a0245dda11ff/overview",

"requirements": [

{

"type": "bank_account.verification.required",

"status": "unverified",

"object_type": "bank_account",

"object_uid": "{{bank_account_uid}}",

"object_url": "https://api-sandbox.onlinebetaalplatform.nl/v1/merchants/{{merchant_uid}}/bank_accounts/{{bank_account_uid}}",

"object_redirect_url": "https://sandbox.onlinebetaalplatform.nl/nl/{{partner_name}}/merchants/{{merchant_uid}}/verificatie/bankgegevens/{{bank_account_uid}}/7a8d3c308b0739ef96320720017d070533912548"

},

...

]

},

...

}

An example of this url can be found below.

3.2. Verify the bank account by redirecting the merchant to the verification_url.

You can find the verification_url in two places: the bank_account object, and the merchant compliance.requirements.

3.2.1. Bank account object

Find the verification_url and redirect the merchant to this link to verify the bank account.

{

"uid": "{{bank_account_uid}}",

"object": "bank_account",

"created": 1554200096,

"updated": 1554200096,

"verified": null

"verification_url": "https://onlinebetaalplatform.nl/nl/{{partner_name}}/merchants/{{merchant_uid}}/verificatie/bankgegevens/{{bank_account_uid}}/7a8d3c308b0739ef96320720017d070533912548",

"status": "new",

...

}

3.2.2. Merchant compliance requirements

Find the requirement with type bank_account.verification.required and redirect the merchant to the object_redirect_url.

{

"uid": "{{merchant_uid}}",

"object": "merchant",

...

"compliance": {

"level": 200,

"status": "unverified",

"overview_url": "https://sandbox.onlinebetaalplatform.nl/en/{{partner_slug}}/{{merchant_uid}}/15c0bdb17283475ec5f274cad0a2a0245dda11ff/overview",

"requirements": [

{

type": "bank_account.verification.required",

"status": "unverified",

"object_type": "bank_account",

"object_uid": "{{bank_account_uid}}",

"object_url": "https://api-sandbox.onlinebetaalplatform.nl/v1/merchants/{{merchant_uid}}/bank_accounts/{{bank_account_uid}}",

"object_redirect_url": "https://sandbox.onlinebetaalplatform.nl/nl/{{partner_name}}/merchants/{{merchant_uid}}/verificatie/bankgegevens/{{bank_account_uid}}/7a8d3c308b0739ef96320720017d070533912548"

}

]

},

...

}

An example of this url can be found below.

3.3 Verify bank seamlessly by redirecting merchant directly to bank / payment method.

In case of Belgium and The Netherlands, we provide a direct link with Bancontact and iDEAL, providing a seamless integration, so that merchants do not see our bank verification screen.

To do this, first find the verification_url by using on of the methods in 3.1.

After that, append additional parameters to the url. Then redirect the user to the new url.

| Additional parameters | |

| payment_method | one of ideal or bcmc |

| issuer | required if payment_method is ideal, one of the SWIFT codes of the iDEAL issuers list. |

https://onlinebetaalplatform.nl/nl/{{partner}}/merchants/{{merchant_uid}}/

verificatie/bankgegevens/

{{bank_account_uid}}/{{hash}}?payment_method=ideal&issuer=INGBNL2A

3.4. Verify using the Files API.

If you wish to create a seamless and smoother user experience while making sure the merchants upload their files without you having to process any sensitive data, then you can rely on the Files API to send us all documents necessary to do the KYC. This consists out of two steps.

3.4.1. Create a one time File Link

You first need to send a POST request to the Files upload endpoint and specify in the parameters the purpose of the file, ‘bank_account_bank_statement’ and provide the UID for which the upload is to be used.

POST https://files-sandbox.onlinebetaalplatform.nl/v1/uploads

{

"purpose": "bank_account_bank_statement",

"merchant_uid": "{{merchant_uid}}",

"object_uid": "{{bank_account_uid}}"

}

That leads to the following response:

{

"uid": "{{file_uid}}",

"created": "1606003200",

"updated": "1606003200",

"expired": "1606004100",

"merchant_uid": "{{merchant_uid}}",

"object_uid": "{{bank_account_uid}}",

"purpose": "bank_account_bank_statement",

"token": "{{token}}",

"url": "https://files-sandbox.onlinebetaalplatform.nl/v1/uploads/{{file_uid}}"

}

3.4.2. Upload the file

In order to finish the operation, you need to send the file via a POST request to the endpoint https://api-sandbox.onlinebetaalplatform.nl/v1/{{file_uid}}.

In the headers of this request, you need to provide the token you previously stored in the field x-opp-files-token and the file in a FILE parameter.

POST https://files-sandbox.onlinebetaalplatform.nl/v1/uploads/{{file_uid}}

Headers

{

"x-opp-files-token": "{{token}"

}

Parameters

{

"file": "{{file}}"

}

3.5. Verify the bank account by performing a transaction.

OPP also supports the ability to verify a merchant's bank account when the merchant itself completes a transaction to another merchant.

This can for example be used to perform buyer onboarding, when the buyer will be a seller at the platform as well. Another case is when you as a platform want to have a dynamic onboarding fee, that differs per merchant. In that case, the {{seller_merchant_uid}} will be your platform merchant.

If the merchant does not yet exist, create a merchant and an 'empty' bank account for this merchant first. This allows you to set the right notify_url and other details. Do note that you do not have to redirect merchant to the bank_account verification_url. You may pass this new merchant's uid as a parameter to the Create Transaction API call using parameter verification_merchant_uid to verify the bank account via this transaction.

POST https://api-sandbox.onlinebetaalplatform.nl/v1/transactions

{

"merchant_uid": "{{seller_merchant_uid}}",

"products": [

{

"name": "Test",

"price": 100,

"quantity": 1

}

],

"return_url": "https://platform.example.com/return/",

"notify_url": "https://platform.example.com/notify/",

"total_price": 100,

"verification_merchant_uid": "{{buyer_merchant_uid}}",

"metadata":

{

"external_id": "2015486"

}

}

The bank account will stay in a new state if this transaction is not successfully completed and will change to state pending if transaction is successfully completed, just like the regular bank account verification flow.

Process of the approval OR disapproval

The compliance team of OPP checks all new or updated verifications within 24 hours on working days and will either approve or disapprove the verification. Notifications are sent as soon as OPP has approved or disapproved the bank account.

Approved:

The bank account information has been approved and has received the status approved. The compliance requirement

bank_account.verification.required has received the status verified and will no longer be visible within the merchant.compliance.requirements.

| Sent notifications | |

|

merchant.compliance_requirement.

status pending > verified

bank_account.status.

status pending > approved

|

|

If the merchant has no other unverified or pending compliance.requirements, then merchant's

compliance.status shall be updated from pending to verified. This change in status will also be sent by the

following notification merchant.compliance_status.changed.

- OR -

Disapproved:

The bank account information has been disapproved and has received the status disapproved. The compliance requirement bank_account.verification.required has received the status unverified.

Merchant is required to verify its bank details again, see step 3.1.

| Sent notifications | |

|

merchant.compliance_requirement.

status pending > unverified

bank_account.status.

status pending > disapproved

|

|

If the merchant's compliance.status was pending, this will be changed to unverified. This change in status will also be sent

by the following notification merchant.compliance_status.changed.

4. Business representative verification

Within the Merchant Object you will find the compliance requirement contact.verification.required. The representative of the business is required to identify him or herself.

There are three ways to provide OPP this identity. You can

- Use the

verification_url. - Use the compliance overview_url.

- Redirect the merchant to the white-label

object_redirect_url. - Verify the identification seamlessly by redirecting directly to a local identification method (such as iDIN or itsme).

- Verify using the Files API.

4.1. Use the whitelabel verification url.

In case you would want to fulfill the contact verification using the contact object, you can do so by using the verification_url in the merchant.contact object.

GET https://api-sandbox.onlinebetaalplatform.nl/v1/merchants/{{merchant_uid}}?expand[]=contacts

{

"livemode": false,

"uid": "{{merchant_uid}}",

"object": "merchant",

...

"contacts": [

{

"uid": "con_59c4c3b3493d",

"object": "contact",

"created": 1604404358,

"updated": 1604404358,

"verified": null,

"status": "unverified",

"verification_url": "https://sandbox.onlinebetaalplatform.nl/en/{{partner_slug}}/merchants/{{merchant_uid}}/verifications/contact-details/{{contact_uid}}/273db5ea58b3ce0fb061608054f32efd258b954d",

"type": "representative",

"title": null,

"name_initials": null,

"name_first": null,

"name_last": null,

"names_given": null,

"birthdate": null,

"partner_name_last": null,

"emailaddresses": [],

"phonenumbers": []

}

],

...

}

After verification, the merchant will be updated, and the platform will receive the notifications that go with these updates.

An example of the verification url can be found below.

4.2. Redirect merchant to compliance overview_url.

You can find the overview_url in the merchant compliance object. Find the overview_url in the compliance object within the merchant and redirect the user to this url.

{

"uid": "{{merchant_uid}}",

"object": "merchant",

...

"compliance": {

"level": 400,

"status": "unverified",

"overview_url": "https://sandbox.onlinebetaalplatform.nl/en/{{partner_slug}}/{{merchant_uid}}/15c0bdb17283475ec5f274cad0a2a0245dda11ff/overview",

"requirements": [

...

]

},

...

}

OPP will send a notification immediately after the identification took place. The compliance.requirement contact.verification.required and the contact status will be pending until OPP performed a compliance check.

An example of this url can be found below.

4.3. Redirect merchant to white-label object_redirect_url.

Within the Merchant Object you will find the compliance requirement contact.verification.required.

Find the object_redirect_url and redirect the merchant to this url to identify him/herself.

Note that this is the same url as the verification_url of 4.1.

{

"uid": "{merchant_uid}",

"object": "merchant",

...

"compliance": {

"level": 400,

"status": "unverified",

"overview_url": "https://sandbox.onlinebetaalplatform.nl/en/{{partner_slug}}/{{merchant_uid}}/e1e477f8c7e6e688c8c752e5e7a4bad448f52a67/overview"

"requirements": [

{

"type": "contact.verification.required",

"status": "unverified",

"object_uid": {{contact_uid}},

"object_type": "contact",

"object_url": "https://api-sandbox.onlinebetaalplatform.nl/v1/merchants/...",

"object_redirect_url": https://sandbox.onlinebetaalplatform.nl/...

}

]

},

...

}

OPP will send a notification immediately after the identification took place. The compliance.requirement contact.verification.required and the contact status will be pending until OPP performed a compliance check.

4.4. Seamlessly identify merchant by redirecting directly to a local idenfication method.

You can skip the whitelabel screens and immediately redirect the user to a local identification method if this is available in your country. Doing this requires three steps:

- Find the

object_redirect_urlorverification_urlas mentioned earlier. - Add the additional parameters as described below to the url.

- Redirect the merchant to the adapted url.

| Additional parameters | |

| verification_type | One of idin or itsme |

| issuer | required if verification_type is idin, one of the SWIFT codes of the

iDIN issuers list. |

https://onlinebetaalplatform.nl/nl/{{partner}}/merchants/{{merchant_uid}}/

verificatie/contactgegevens

/{{contact_uid}}/{{hash}}?verification_type=idin&issuer=INGBNL2A

4.2.5. Verify using the Files API.

If you wish to create a seamless and smoother user experience while making sure the merchants upload their files without you having to process any sensitive data, then you can rely on the Files API to send us all documents necessary to do the KYC. This consists out of two steps.

4.2.5.1. Create a one time File Link

You first need to send a POST request to the Files upload endpoint and specify in the parameters the purpose of the file, ‘representative_passport’ and provide the UID for which the upload is to be used.

POST https://files-sandbox.onlinebetaalplatform.nl/v1/uploads

{

"purpose": "representative_passport",

"merchant_uid": "{{merchant_uid}}",

"object_uid": "{{contact_uid}}"

}

That leads to the following response:

{

"uid": "{{file_uid}}",

"created": "1606003200",

"updated": "1606003200",

"expired": "1606004100",

"merchant_uid": "{{merchant_uid}}",

"object_uid": "{{contact_uid}}",

"purpose": "representative_passport",

"token": "{{token}}",

"url": "https://files-sandbox.onlinebetaalplatform.nl/v1/uploads/{{file_uid}}"

}

4.2.5.2. Upload the file

In order to finish the operation, you need to send the file via a POST request to the endpoint https://api-sandbox.onlinebetaalplatform.nl/v1/{{file_uid}}.

In the headers of this request, you need to provide the token you previously stored in the field x-opp-files-token and the file in a FILE parameter.

POST https://files-sandbox.onlinebetaalplatform.nl/v1/uploads/{{file_uid}}

Headers

{

"x-opp-files-token": "{{token}"

}

Parameters

{

"file": "{{file}}"

}

OPP will send a notification immediately after the identification took place. The compliance.requirement contact.verification.required

and the contact status will be pending until OPP performed a compliance check.

Process of the approval OR disapproval

The compliance team of OPP checks all new or updated verifications within 24 hours on working days and will either approve or disapprove the verification. Notifications are sent as soon as OPP has approved or disapproved the identification.

Approved:

The identification has been approved and has received the status verified. The compliance requirement contact.verification.required

has been updated with the status verified and is no longer visible within the merchant.compliance.requirements.

| Sent notifications | |

|

merchant.compliance_requirement.

status pending > verified

contact.status.

status pending > verified

|

|

If the merchant has no other unverified or pending compliance.requirements, merchant's

compliance.status will be updated from pending to verified. This change in status will

also be sent by the following notification merchant.compliance_status.changed.

- OR -

Disapproved:

The identification has been disapproved and has received the status unverified. The compliance requirement contact.verification.required

has been updated with the status unverified. The merchant is required to identify itself again, see step 1.

| Sent notifications | |

|

merchant.compliance_requirement.

status pending > unverified

contact.status.

status pending > unverified

|

|

If the merchant's compliance.status was pending, this will be updated to unverified. This change in status will also be sent by the

following notification merchant.compliance_status.changed.

5. Fulfill other requirements

A business merchant might have several other compliance requirements to fulfill:

- Contact phone verification.

- UBO verification.

- Chamber of Commerce extract.

- Organization structure.

5.1. Contact phone verification

Once the business merchant is created, you will find the contact.phonenumber.required requirement. OPP needs to have a phonenumber that belongs to the representative who verified in step 4. We are legally bound to have a verified phonenumber and email address from every merchant, in order to contact him/her when something is wrong with a transaction or verification.

You as a partner have to deal with the verification of an email address before creating the merchant.

For phone number verification, OPP provides the choice to do it yourself, or let us do the phonenumber verification.

"uid": "{{merchant_uid}}",

"object": "merchant",

...

"compliance": {

"level": 400,

"status": "unverified",

"overview_url": "https://sandbox.onlinebetaalplatform.nl/en/{{partner_slug}}/{{merchant_uid}}/feabfd98b2a9d246a6e33742f92af061059b9f81/overview",

"requirements": [

{

"type": "contact.phonenumber.required",

"status": "unverified",

"object_type": "contact_phonenumber",

"object_uid": null,

"object_url": null,

"object_redirect_url": "https://sandbox.onlinebetaalplatform.nl/en/{{partner_slug}}/merchants/{{merchant_uid}}/verifications/phonenumber-form/{{contact_uid}}/feabfd98b2a9d246a6e33742f92af061059b9f81"

}]

...

If you prefer to do verification yourself, you can choose to do this at the very beginning, before creating a merchant at our side, or when the merchant already exists. In the compliance requirements, find the object_redirect_url and redirect the representative of the business to this url. If you would prefer a seamless solution, you can do this by performing a POST on the contact object as can be seen on the right. Once the phonenumber is filled in, the merchant will be updated and the notifications will be send.

POST https://api-sandbox.onlinebetaalplatform.nl/v1/merchants/{{merchant_uid}}/contacts/{{contact_uid}} \

{

"phonenumbers": [

{

"phonenumber": "0612345678"

}

]

}

In case you want OPP to do the verification, you will find a object_redirect_url in the contact.phonenumber.verification.required compliance requirement. Redirect the user to this url, where (s)he can fill in the phonenumber to be verified.

A text message will be send to the phonenumber, which needs to be filled in to verify the phonenumber.

The requirement will then disappear.

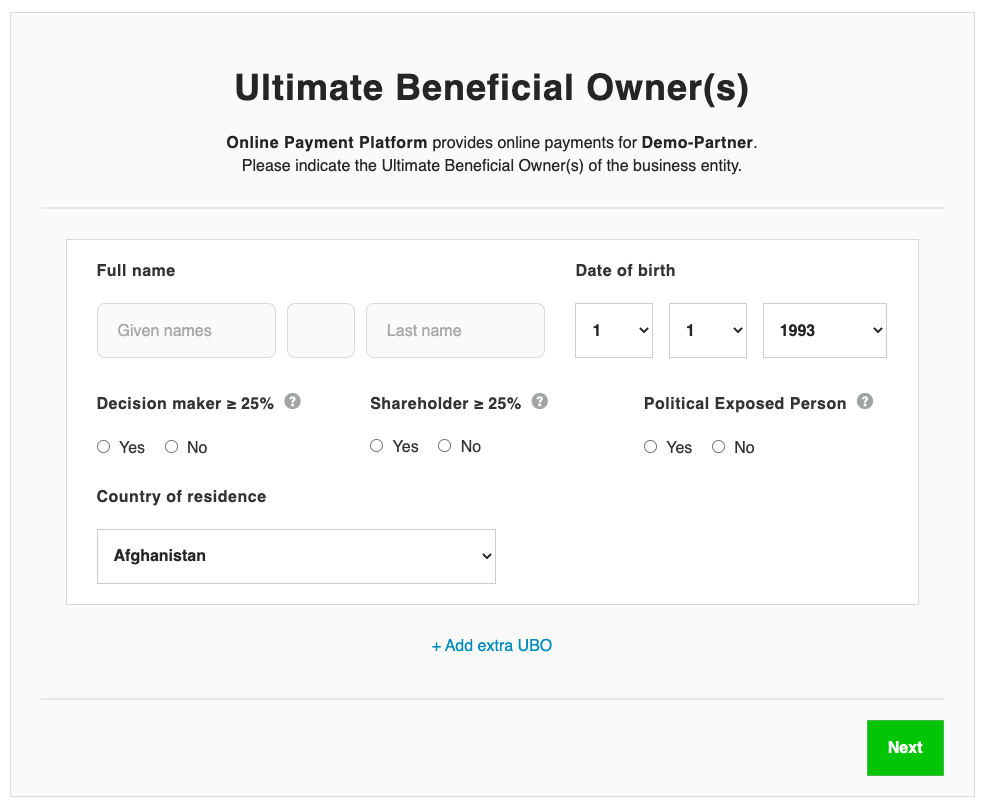

5.2. UBO verification

OPP is obliged to trace all Ultimate Beneficial Owners (UBO) of a business entity. Legal business entities such as a B.V., GmbH or BVBA may have more than one UBO. When checking the business verifications, OPP determines whether the UBO verification is required. This verification is therefore never directly required when creating the merchant.

An UBO is a natural person that has at least one of the following:

- 25% of the shares or exercising voting rights

- effective control of the company or organization

- 25% or more beneficiary rights on the capital OR

- special control of 25% or more on the capital

As a partner, you can either choose to already provide us with the UBO information, or wait for the requirement to arrive. If our compliance department finds an UBO that has not registered yet, the compliance requirement ubo.required will be triggered.

You can then choose to seamlessly provide the UBO information as described in the documentation, or redirect the merchant to the object_redirect_url to fulfill the requirement.

{

"uid": "{{merchant_uid}}",

"object": "merchant",

...

"compliance": {

"level": 400,

"status": "unverified",

"requirements": [

{

"type": "ubo.required",

"status": "unverified",

"object_uid": null,

"object_type": "null",

"object_url": "https://api-sandbox.onlinebetaalplatform.nl/v1/merchants/...",

"object_redirect_url": https://sandbox.onlinebetaalplatform.nl/...

}

]

},

...

}

An example of the redirect url can be found below:

Now that the required UBO has been created, you will receive a notification with type merchant.compliance_requirement.status.changed.

The compliance requirement ubo.required is set to verified, and is being replaced by ubo.verification.required, which has status pending as all information has just been provided.

OPP will send the following notifications when the UBO verification is required:

| Sent notifications | |

|

merchant.compliance_status.

status pending/verified > unverified

|

|

The compliance team of OPP checks all new or updated verifications within 72 hours on working days and will either approve or disapprove the verification. Notifications are sent as soon as OPP has approved or disapproved the identification.

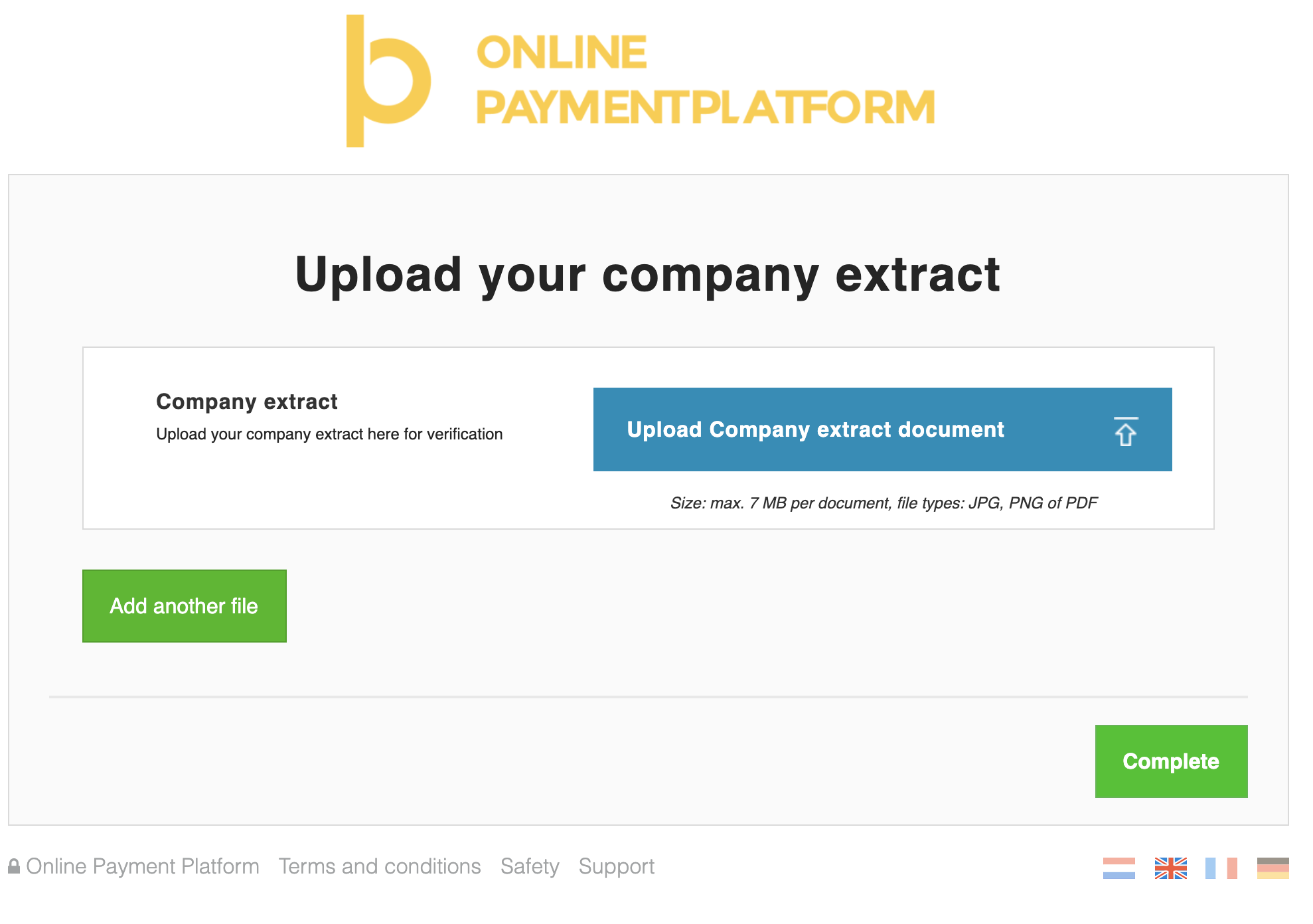

5.3. Chamber of Commerce extract

In case our compliance department is unable to retrieve the chamber of commerce extract from our registers, you might be required to deliver this to us.

In that case, you will find the coc_extract.required type of requirement in your compliance requirements.

There are three ways to fulfill this requirement:

- Use the compliance overview_url.

- Use the verification_url.

- Verify using the Files API.

Redirect the merchant to the object_redirect_url to fulfill this requirement.

{

"uid": "{{merchant_uid}}",

"object": "merchant",

...

"compliance": {

"level": 400,

"status": "unverified",

"requirements": [

{

"type": "coc_extract.required",

"status": "unverified",

"object_type": null,

"object_uid": null,

"object_url": null,

"object_redirect_url": "https://sandbox.onlinebetaalplatform.nl/en/{{partner_name}}/merchants/{{merchant_uid}}/verifications/coc-extract/feabfd98b2a9d246a6e33742f92af061059b9f81"

}

]

},

...

}

An example of the url can be found below:

The chamber of commerce extract can also be uploaded using our Files API as follows. If you wish to create a seamless and smoother user experience while making sure the merchants upload their files without you having to process any sensitive data, then you can rely on the Files API to send us all documents necessary to do the KYC. This consists out of two steps.

5.3.3.1 Create a one time File Link

You first need to send a POST request to the Files upload endpoint and specify in the parameters the purpose of the file, ‘coc_extract’ and provide the UID for which the upload is to be used.

POST https://files-sandbox.onlinebetaalplatform.nl/v1/uploads

{

"purpose": "coc_extract",

"merchant_uid": "{{merchant_uid}}",

"object_uid": "{{merchant_uid}}"

}

That leads to the following response:

{

"uid": "{{file_uid}}",

"created": "1606003200",

"updated": "1606003200",

"expired": "1606004100",

"merchant_uid": "{{merchant_uid}}",

"object_uid": "{{merchant_uid}}",

"purpose": "coc_extract",

"token": "{{token}}",

"url": "https://files-sandbox.onlinebetaalplatform.nl/v1/uploads/{{file_uid}}"

}

5.3.3.2. Upload the file

In order to finish the operation, you need to send the file via a POST request to the endpoint https://api-sandbox.onlinebetaalplatform.nl/v1/{{file_uid}}.

In the headers of this request, you need to provide the token you previously stored in the field x-opp-files-token and the file in a FILE parameter.

POST https://files-sandbox.onlinebetaalplatform.nl/v1/uploads/{{file_uid}}

Headers

{

"x-opp-files-token": "{{token}"

}

Parameters

{

"file": "{{file}}"

}

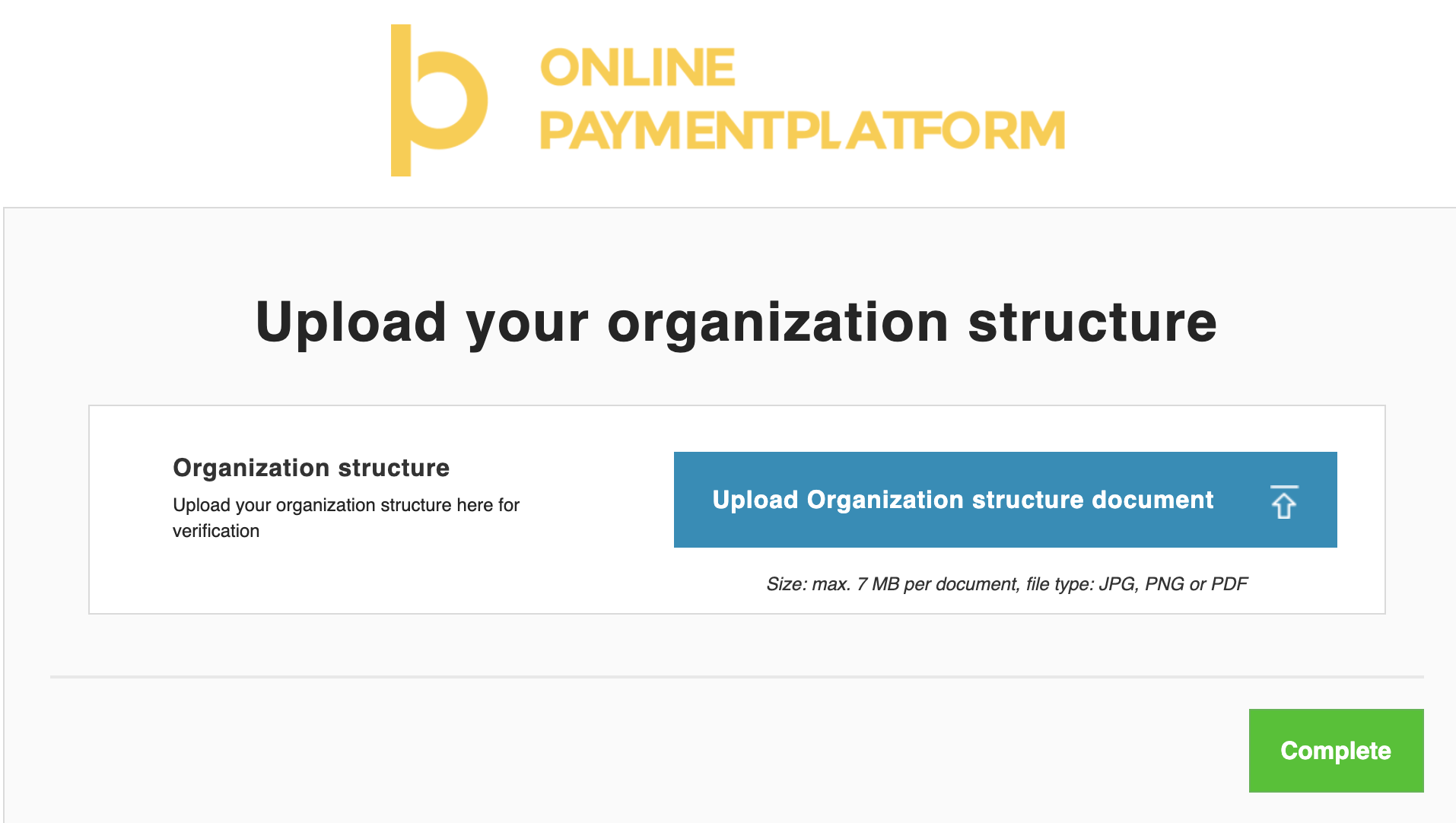

5.4. Organization structure

In case our compliance department is unable to create an organization structure, e.g. because parts are unknown by the Chamber of Commerce, you might be required to deliver this to us.

In that case, you will find the organization_structure.required type of requirement in your compliance requirements.

There are three ways to fulfill this requirement:

- Use the compliance overview_url.

- Use the verification_url.

- Verify using the Files API.

object_redirect_url to fulfill this requirement.

{

"uid": "{{merchant_uid}}",

"object": "merchant",

...

"compliance": {

"level": 400,

"status": "unverified",

"requirements": [

{

"type": "organization_structure.required",

"status": "unverified",

"object_type": null,

"object_uid": null,

"object_url": null,

"object_redirect_url": "https://sandbox.onlinebetaalplatform.nl/en/{{partner_name}}/merchants/{{merchant_uid}}/verifications/organization-structure/feabfd98b2a9d246a6e33742f92af061059b9f81"

}

]

},

...

}

An example of the url can be found below:

The organization structure can also be uploaded using our Files API as follows. If you wish to create a seamless and smoother user experience while making sure the merchants upload their files without you having to process any sensitive data, then you can rely on the Files API to send us all documents necessary to do the KYC. This consists out of two steps.

5.4.3.1 Create a one time File Link

You first need to send a POST request to the Files upload endpoint and specify in the parameters the purpose of the file, ‘coc_extract’ and provide the UID for which the upload is to be used.

POST https://files-sandbox.onlinebetaalplatform.nl/v1/uploads

{

"purpose": "organization_structure",

"merchant_uid": "{{merchant_uid}}",

"object_uid": "{{merchant_uid}}"

}

That leads to the following response:

{

"uid": "{{file_uid}}",

"created": "1606003200",

"updated": "1606003200",

"expired": "1606004100",

"merchant_uid": "{{merchant_uid}}",

"object_uid": "{{merchant_uid}}",

"purpose": "organization_structure",

"token": "{{token}}",

"url": "https://files-sandbox.onlinebetaalplatform.nl/v1/uploads/{{file_uid}}"

}

5.4.3.2. Upload the file

In order to finish the operation, you need to send the file via a POST request to the endpoint https://api-sandbox.onlinebetaalplatform.nl/v1/{{file_uid}}.

In the headers of this request, you need to provide the token you previously stored in the field x-opp-files-token and the file in a FILE parameter.

POST https://files-sandbox.onlinebetaalplatform.nl/v1/uploads/{{file_uid}}

Headers

{

"x-opp-files-token": "{{token}"

}

Parameters

{

"file": "{{file}}"

}

Change Bank account

Occasionally, merchants would like to change their IBAN for payouts, because of many reasons. Research has shown us that many partners get these questions, and forward them to the OPP support team. You can create a button to change the IBAN account for payouts as follows.

Please note that whenever a new bank_account is created, the old bank_account cannot be used for payouts anymore. In case the merchant has second thoughts, and does want the first bank_account for payouts, (s)he will have to verify it again.

Step 1: Check whether the merchant has a bank_account with status new

First, we must find out whether the merchant already has a bank_account that can be filled. This is an important step, to keep your, and our database free of noise. Besides that, every time a new bank_account is created, the old bank_account will not be used for payouts anymore. This means that eventually, the merchant could not have a connected IBAN at all, if we do not keep track.

Find the merchant bank_accounts, and filter the status new by using the following call:

GET https://api-sandbox.onlinebetaalplatform.nl/v1/merchants/{{merchant_uid}}/bank_accounts?filter[status]=new

Step 2.1: Merchant already has an outstanding bank_account

Get the bank_account with status new, and redirect the user to the verification_url.

{

"uid": "{{bank_account_uid}}",

"object": "bank_account",

"created": 1554200096,

"updated": 1554200096,

"verified": null

"verification_url": "https://onlinebetaalplatform.nl/nl/

{{partner_name}}/merchants/{{merchant_uid}}/verificatie/

bankgegevens/{{bank_account_uid}}/7a8d3c308b0739ef96320720017d070533912548",

"status": "new",

...

}

After the merchant has gone through the process, you will receive a notification with type bank_account.status.changed. The status is now pending.

After our compliance department has checked the new bank_account, you will again receive a notification with type bank_account.status.changed.

This can either be approved, or disapproved. When approved, the bank_account will be used for payouts.

Step 2.2: Merchant has no outstanding bank_account

Create a new bank_account, as described in the Docs. Then redirect the user to the verification_url.

After the merchant has gone through the process, you will receive a notification with type bank_account.status.changed. The status is now pending.

After our compliance department has checked the new bank_account, you will again receive a notification with type bank_account.status.changed.

This can either be approved, or disapproved. When approved, the bank_account will be used for payouts.

Compliance

A merchant can be a consumer or a business entity and each has its own set of KYC (Know Your Customer) compliance requirements. OPP is obliged to do this KYC check, to see if the consumer or business has been in touch with illegal activities, like money laundering or finance of terrorism, or other frauds.

The merchant object contains the ‘compliance’ object. This object contains details on the merchant's current compliance level (1) , compliance status (2) and lists the compliance requirements (3) the merchant should meet to get a verified compliance status. An unverified compliance status results in not being able to receive payouts.

Receive the merchant object using this call:

GET https://api.onlinebetaalplatform.nl/v1/merchants/{{merchant_uid}}

{

"uid": "{{merchant_uid}}",

"object": "merchant",

...

"compliance": {

"level": 200,

"status": "unverified",

"requirements": [

{

"type": "bank_account.verification.required",

"status": "unverified",

"object_uid": {{bank_account_uid}},

"object_type": "bank_account",

"object_url": "https://api-sandbox.onlinebetaalplatform.nl/v1/merchants/...",

"object_redirect_url": https://sandbox.onlinebetaalplatform.nl/...

}

]

},

...

}

Compliance levels

The compliance levels determine which compliance requirements the merchant should meet.

| Compliance levels | |

| 100 |

Merchant has been created but does not yet have a linked bank account. Transactions can be created on level 100 but cannot yet be paid out to the merchant. |

| 200 Low KYC |

Once the partner creates a bank account object for the merchant, the compliance level of the merchant is updated to 200. OPP will review the bank account information provided and once approved the merchant can receive payouts of the money on the bank account. Thresholds: the standard thresholds for Level 200 merchants are € 250,- in one transaction or € 1.500,- in lifetime volume. After which the merchant is required to identify itself before payouts can be reactivated. This threshold can be adjusted based on the risk profile and assessment of the platform or marketplace. |

| 400 High KYC |

If the merchant passes the threshold the compliance level is updated to 400 and is obliged to confirm his or her identity. The merchant can do this by uploading an identity document or by performing a local identification method (such as iDIN or itsme). |

Compliance status

The compliance status determines whether or not a merchant is able to receive payouts. You may expect the following states:

| Compliance statuses | |

| Unverified | Merchant is unverified and unable to receive payouts. Merchant should meet all unverified ‘compliance requirements’ to get to the ‘verified’ state. Unverified means that no verifications have been done yet, or delivered verifications have been disapproved. |

| Pending | Merchant compliance status is pending and is unable to receive payouts. OPP is currently reviewing the merchant's updated ‘compliance requirements’. |

| Verified | Merchant compliance status is verified and the merchant is able to receive payouts. |

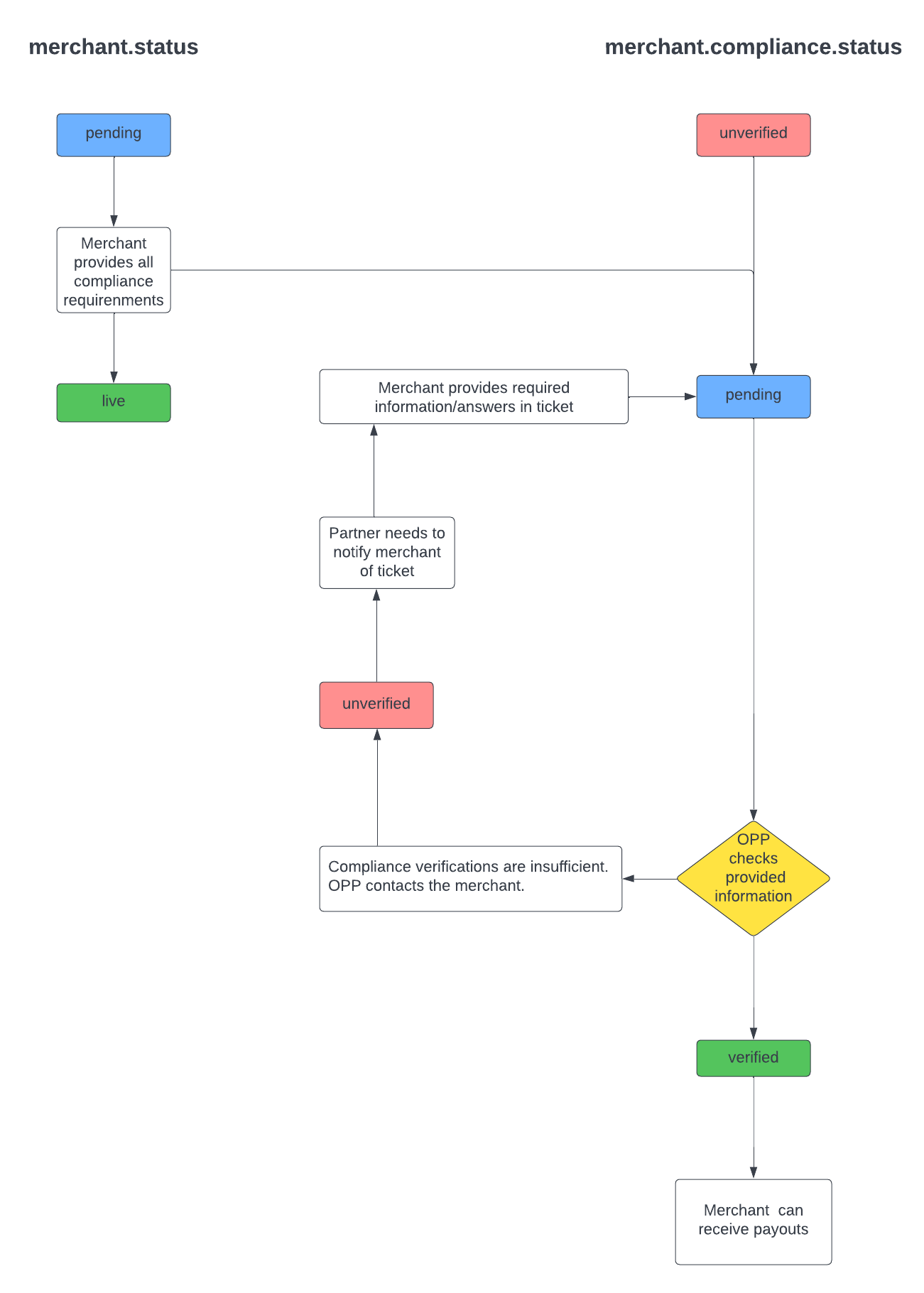

Merchant onboarding process

The flow below illustrates how the Merchant status and the Merchant Compliance Status change over the course of the onboarding process. It additionally shows when you as a Partner need to take action as a consequence of the merchant providing insufficient documents and when the merchant will need to take action.

Compliance requirements

Each compliance requirement states the compliance requirement type and details of the related object. A merchant can be redirect to object_redirect_url in order to get to the whitelabel OPP page where the required actions will be explained and can be finalized. It is also possible to provide your own redirect URL and seamlessly integrate these compliance requirement steps.

| Compliance requirements | |

| bank_account.required | No bank account available while at least one is required. |

| bank_account.verification.required | No verified bank account available while at least one verified bank account is required. |

| contact.verification.required | No verified merchant contact available. |

| contact.phonenumber.required | No phonenumber available, while at least one is required. |

| contact.phonenumber.verification.required | No verified phonenumber available, while at least one is required. |

| coc_extract.required | ( BUSINESS ONLY! ) Compliance does not have a state of the art extract, and will trigger the option to deliver it. |

| organization_structure.required | ( BUSINESS ONLY! ) Compliance cannot create a clear view on the organization structure, and will trigger the option to deliver it. |

| ubo.required | ( BUSINESS ONLY! ) Compliance found that an UBO is required, and will trigger the option to verify. |

| ubo.verification.required | ( BUSINESS ONLY! ) The merchant has to fill / verify all UBO’s. |

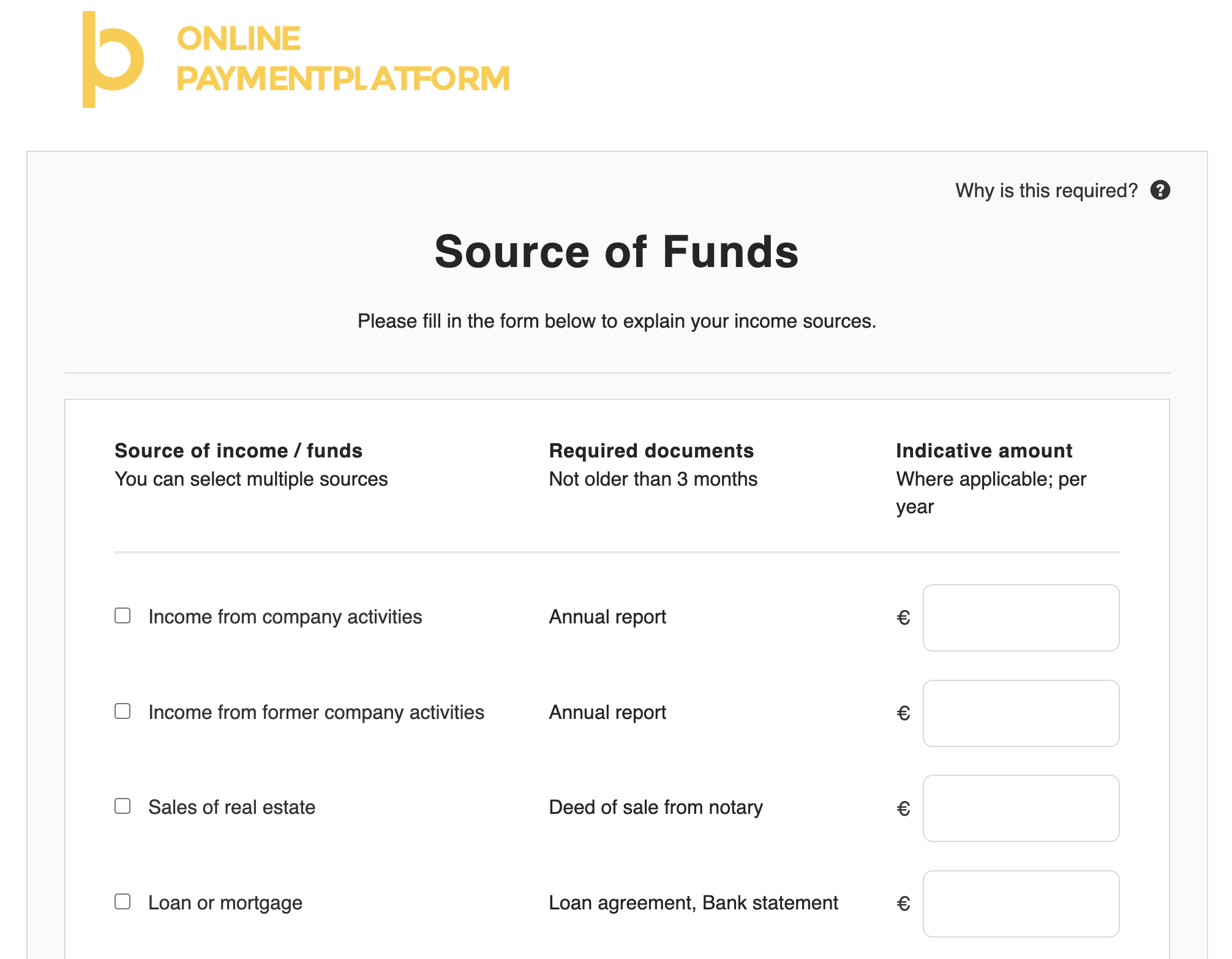

Source of Funds

When certain thresholds are met or transaction monitoring raises a flag, our compliance team can trigger a source of funds requirement. The source of funds requirement allows us to do research to where the amount of money came from. Most often, this will be used in Donation or Crowdfunding solutions.

When this is triggered, you will see the source_of_funds.required requirement in the merchant compliance object.

}

...

"requirements": [

{

"type": "source_of_funds.required",

"status": "unverified",

"object_type": "source_of_fund",

"object_uid": "{{sof_uid}}",

"object_url": null,

"object_redirect_url": "https://sandbox.onlinebetaalplatform.nl/nl/testindividual/merchants/{{merchant_uid}}/verificaties/bron-van-de-middelen/{{sof_uid}}/5fa9a435b8b66267aaddb2db48dfe9a74b7e544f"

}

]

},

...

}

To verify the source of funds, we can follow three routes:

- Use the compliance overview_url.

- Use the object_redirect_url.

- Verify using the Files API.

In all cases OPP will send a notification right after the verification took place.

The compliance requirement source_of_funds.required status will be pending until OPP has performed a compliance check.

1. Verify the source of funds requirement by redirecting the merchant to the compliance overview_url

You can find the overview_url in the merchant compliance object. Find the overview_url in the compliance object within the merchant and redirect the user to this url.

{

"uid": "{{merchant_uid}}",

"object": "merchant",

...

"compliance": {

"level": 400,

"status": "unverified",

"overview_url": "https://sandbox.onlinebetaalplatform.nl/en/{{partner_slug}}/{{merchant_uid}}/15c0bdb17283475ec5f274cad0a2a0245dda11ff/overview",

"requirements": [

{

"type": "source_of_funds.required",

"status": "unverified",

"object_type": "source_of_fund",

"object_uid": "{{sof_uid}}",

"object_url": null,

"object_redirect_url": "https://sandbox.onlinebetaalplatform.nl/en/{{partner_slug}}/merchants/{{merchant_uid}}/verifications/source-of-funds/{{sof_uid}}/5fa9a435b8b66267aaddb2db48dfe9a74b7e544f"

}

]

},

...

}

An example of this url can be found below.

2. Verify the source of funds requirement by redirecting the merchant to the object_redirect_url.

You can find the object_redirect_url in the merchant compliance.requirements.

Find the requirement with type source_of_funds.required and redirect the merchant to the object_redirect_url.

{

"uid": "{{merchant_uid}}",

"object": "merchant",

...

"compliance": {

"level": 200,

"status": "unverified",

"overview_url": "https://sandbox.onlinebetaalplatform.nl/en/{{partner_slug}}/{{merchant_uid}}/15c0bdb17283475ec5f274cad0a2a0245dda11ff/overview",

"requirements": [

{

"type": "source_of_funds.required",

"status": "unverified",

"object_type": "source_of_fund",

"object_uid": "{{sof_uid}}",

"object_url": null,

"object_redirect_url": "https://sandbox.onlinebetaalplatform.nl/en/{{partner_slug}}/merchants/{{merchant_uid}}/verifications/source-of-funds/{{sof_uid}}/5fa9a435b8b66267aaddb2db48dfe9a74b7e544f"

}

]

},

...

}

An example of this url can be found below.

3. Verify the source of funds requirement by using the Files API.